Looking to get started with online market research? This guide will teach you everything you need to know.

What Is Online Market Research?

Online market research is the process of collecting data on a specific market online. Usually with the intention to analyze the data and gain insights that would inform a business strategy.

The term market refers to a segment of the overall population a business aims to target with its products or services.

It is usually a specific group of potential customers who share common characteristics. Like demographic information, geographic location, psychographic traits, or behavioral patterns.

There are several methods for online market research. Like interviews, surveys, focus groups, keyword research, and more.

When to Perform Online Market Research

Online market research is a crucial first step in making a variety of business decisions, including:

- Starting a business

- Creating a pricing strategy

- Launching new product or service

- Entering a new market

- Drafting a marketing campaign

There are a whole host of benefits that make market research helpful in the above situations. Let's review them.

What Are the Benefits of Online Market Research?

Performing online market research has a lot of benefits. It can help you:

Get a Deeper Understanding of Audience Attributes

Online market research helps you understand the demographics, psychographics, influences, pain points, and purchase preferences of the audience in your target market. Use that to create detailed buyer personas.

Those buyer personas help your team create more effective products, advertising, marketing campaigns, and sales strategies.

Learn About Customer Behavior and the Customer Journey

Use data obtained during online market research to learn more about customer behavior. And to gain a better understanding of the customer journey. That’s the process customers go through between experiencing a problem your product or service can solve and making a purchase.

Both sets of insights help you craft experiences that support your ideal buyers step-by-step until they buy.

Create Products or Services Your Audience Will Like

Online market research also aids in product or service development.

That’s because it helps you understand market gaps and needs. Addressing these with your business’ product or service offering helps make it appealing to that group.

Find Out What Your Competitors Are Doing

Another crucial aspect of online market research is getting a better understanding of the strategies your competitors are using. Plus your competitor’s strengths and weaknesses.

Use those insights to inform your own business strategy. And get a better chance of succeeding in the market against them.

Identify Your Best Marketing Channels

When you understand your target audience’s preferences and behavior, it’s easier to identify the best marketing channels for your product or service.

Get a better return on your marketing investment by focusing on channels with the highest potential to convert.

How to Conduct Market Research Online

Ready to get started?

Follow our step-by-step process for doing market research online.

1. Establish Your Research Objective

Every online market research effort starts with a clear objective. In other words, you need to decide what you’re trying to learn.

Are you looking to identify new markets with the greatest opportunity? Find insights you can use to rebrand your business for greater impact in a certain market? Or discover ways to improve sales within existing markets?

Make sure you’re clear on your objective since it’s going to dictate the way you approach market research. Mainly the research methods you decide to use.

2. Create a Market Research Plan and Methodology

Once you’ve decided on the main objective for your research, create a market research plan.

It should outline the instruments and tools you’ll use to collect and analyze data, as well as the budget and resources needed to conduct the research.

At this point, you’ll also need to decide on your research methodology mix. You have two types of research methods at your disposal: primary and secondary market research.

Primary vs. Secondary Market Research

Primary market research involves collecting your own data. You’d use research methods like:

- Surveys

- Interviews

- Focus groups

Secondary market research uses data from existing sources, such as:

- Studies

- Trend reports

- Benchmark reports

Keep in mind that you can combine primary and secondary market research—there’s no need to limit yourself to just one or the other.

Qualitative vs. Quantitative Analysis

Research can be based on qualitative or quantitative analysis.

Qualitative analysis uses non-numerical data to generate market insight. Like consumer opinions expressed in interviews or focus groups.

For example, if you find out in a focus group that the majority of people interviewed think your logo is difficult to read, and that your tagline isn’t relevant to their concerns, that’s an example of qualitative analysis.

Quantitative analysis focuses on numerical data. It can be obtained through online market research polls or surveys.

An example of quantitative analysis would be finding out the number of people in a specific market who’ve already purchased a product from your top competitor.

Depending on the goals of your market research, qualitative and quantitative insights might both be useful.

3. Gather Data with Online Research

Once you’ve decided on a research plan and methodology that’ll help you reach your goal, it’s time to gather your data.

Here are some of the main ways to collect data for online market research:

Analyze Your Competitors

Your competitors and their online activities can be a major source of valuable data for your research.

For example, you might find it worthwhile to learn:

- How much website traffic competitors are getting

- Which keywords they rank highly for in search results

- How much they’re spending on online advertising

Research Current Trends

Researching current trends is another central aspect of almost all market research efforts.

You can gather your own data for this—for example, by surveying a representative sample of your target audience. Or you can review recent reports on market trends published by reputable companies in your industry. Or research agencies such as Forrester, Pew Research, or Gartner.

Gather Insights from Organic Traffic Trends

Examining the way people search online and the websites they frequent can help you get a better understanding of market trends.

Use keyword research tools, such as Keyword Overview and Keyword Magic Tool from Semrush, to understand what people are searching for online. And which search queries or keywords they use.

Use a tool like Traffic Analytics to understand which websites people in your target market frequent. And how much traffic popular websites in your industry are getting, what their top traffic sources are, the geographical breakdown of their website visitors, and more.

Use Social Media

Social media platforms are another good way to understand how people feel about your brand, products, services, or competitors. They allow you to get a glimpse into the market’s needs and preferences.

Here are a few ways you can use social media for market research:

- Create a list of the biggest social media influencers in your industry and follow them to see what topics they’re posting about and how people respond to their content

- Follow the social media profiles of popular brands in your industry to learn more about topics your target audience is interested in

- Use social listening software to monitor specific keywords, hashtags, or brand mentions

Leverage Customer Feedback

Your customers can be a great source of information for your market research. Since they’ve already shown that they need what you sell and they fit your target audience, their opinion is highly valuable.

Chances are, they’re already leaving feedback you can review.

Gather customer feedback from reviews of your products, emails they’ve sent to customer support, and their comments on your social media.

Interview Customers

While existing customer feedback is a highly valuable source of data for market research, it might not provide you with all the information you’re looking for.

You can also seek out customers to interview directly. Ask specific questions on things you’d like to learn more about.

Start by emailing your customer list to set up interviews. You might need to offer an incentive (such as a gift card or discounted products) to get customers to spend their time on an interview.

Set Up an Online Focus Group

An online focus group can also provide highly valuable qualitative data.

Here’s how it works:

You recruit 5-10 participants to join an online meeting for a discussion on a specific topic (e.g., your product or service). Then, you guide the discussion while making sure all participants share their view on the topic.

A focus group discussion can also be unguided. And participants can discuss the topic among themselves in addition to answering the researcher’s questions.

To conduct the discussion online, use a video conferencing platform such as Zoom.

Join Online Communities

Online communities can help you get a better understanding of your target audience’s needs, preferences, and perceptions.

Whatever industry you’re in, there are likely a dozen or more dedicated communities already out there. These could be online forums, Slack groups, Facebook groups, or subreddits on Reddit.

Join these communities, read through the discussions, and interact with members to gather valuable data.

Use Online Surveys

Online market research surveys can provide qualitative and quantitative data for your market research.

You’ll need to decide whether you want to survey customers or non-customers that fit your target audience. Or both.

When surveying your own customers, take advantage of your customer email list to survey people at scale. Alternatively, survey non-customers using platforms like SurveyMonkey or Pollfish.

4. Analyze the Data

Once you’ve gathered data from multiple sources, it’s time to analyze it.

At this stage, you’ll need to:

- Organize your data: Some tools you can use at this stage include Google Sheets, Notion, and Airtable

- Extract insights: Remember to keep your original research objective in mind here

- Summarize your findings: It’s important to summarize your findings in a way that will make them easily digestible by anyone reading your market research report. Use simple and clear language. And add visualizations in the form of charts or graphs (if applicable).

Best Practices for Online Market Research

Check out these best practices before you get started with online market research.

Ensure Data Accuracy and Privacy

This is crucial for effective and ethical market research.

Inaccurate data can lead to flawed conclusions. And decisions based on flawed conclusions can hurt your business outcomes.

A few ways to ensure data accuracy when doing market research include validating your research instruments (e.g., surveys), using data-verification checks, and conducting data-cleaning procedures.

Apart from making sure your data is accurate, it also needs to be collected in a way that respects the privacy of the participants. This isn’t just an ethical imperative. It’s also important for encouraging honest responses and safeguarding legal compliance.

To ensure data privacy during market research, you should remove any personally identifiable information (PII) from your data, store the data in a secure environment (such as an encrypted database), and require all involved parties to sign confidentiality agreements.

Use Multiple Research Methods

Using multiple research methods can help you get a more comprehensive understanding of the state of your market. You’ll get different insights from each method. This adds depth and richness to your data.

Using more than one research method is also helpful for verifying data—if multiple methods show similar results, you can be more confident in your findings.

It’s also possible that multiple research methods will better support your objectives.

For example, gathering quantitative data might tell you statistically which market has the biggest opportunity in terms of sales. And qualitative feedback might tell you how potential customers in that market subjectively feel about products like yours. Together, the data from various research methods tells a more complete story.

Pretest Research Instruments

Before deploying your research instruments (e.g., surveys or interviews) at scale, it’s important to test them. This helps ensure they’re easy to use and don’t cause confusion for participants.

Among other things, pretesting can help you uncover response bias, leading questions, and questions that don’t provide meaningful answers.

You’ll want to pretest each research instrument with a few participants to make sure everything is working as intended. Then roll it out to your full list of participants.

Work with a Representative Sample

In market research, it’s usually impossible (or too expensive) to survey everyone in your target market. That’s why market researchers opt for surveying a representative sample.

A representative sample is a subset or group that accurately represents a larger population. One important thing to note is that the number of participants you need for a representative sample depends on the size of the total population.

For example, a population consisting of 100,000 people will inevitably require a larger sample size compared to a population of 20,000 people.

You can use one of the many representative sample size calculators available online to calculate the total number of participants you’ll need for your target market.

Usually, you’ll need to enter the total population size, choose a confidence level (e.g., 95%), and enter a margin of error you’re comfortable with.

Ensure Neutrality and Lack of Bias

Your research findings will be more accurate and reliable if you validate researcher neutrality and lack of bias.

Researchers should have clear objectives, use an unbiased and neutral tone in all communication with participants, and stay objective throughout the entire research process. A few ways you can maintain neutrality and lack of bias include:

- Using random sampling techniques to choose participants

- Avoiding leading questions when performing surveys

- Having your findings reviewed by other peers in the field

Perform Continuous Research

Market conditions, preferences, and sentiments inevitably change over time.

Performing continuous market research will help you stay on top of changes. And allow you to have an accurate understanding of the market at all times.

This will give your business the best chance of succeeding in the market.

Some examples of research methods that would be helpful for monitoring market changes include surveys, social media monitoring, and trend analysis.

Online Market Research Tools and Resources

Here are some of the best online market research tools and resources that can streamline your market research efforts.

Organic Research

Organic search (e.g., searching for a topic using a search engine like Google) is how the majority of internet users start searching for a product or service online. The search queries they type into a search engine to find what they need are called “keywords.”

Understanding which keywords people use to find products or services similar can help you understand how to optimize your website to rank better in search engine results.

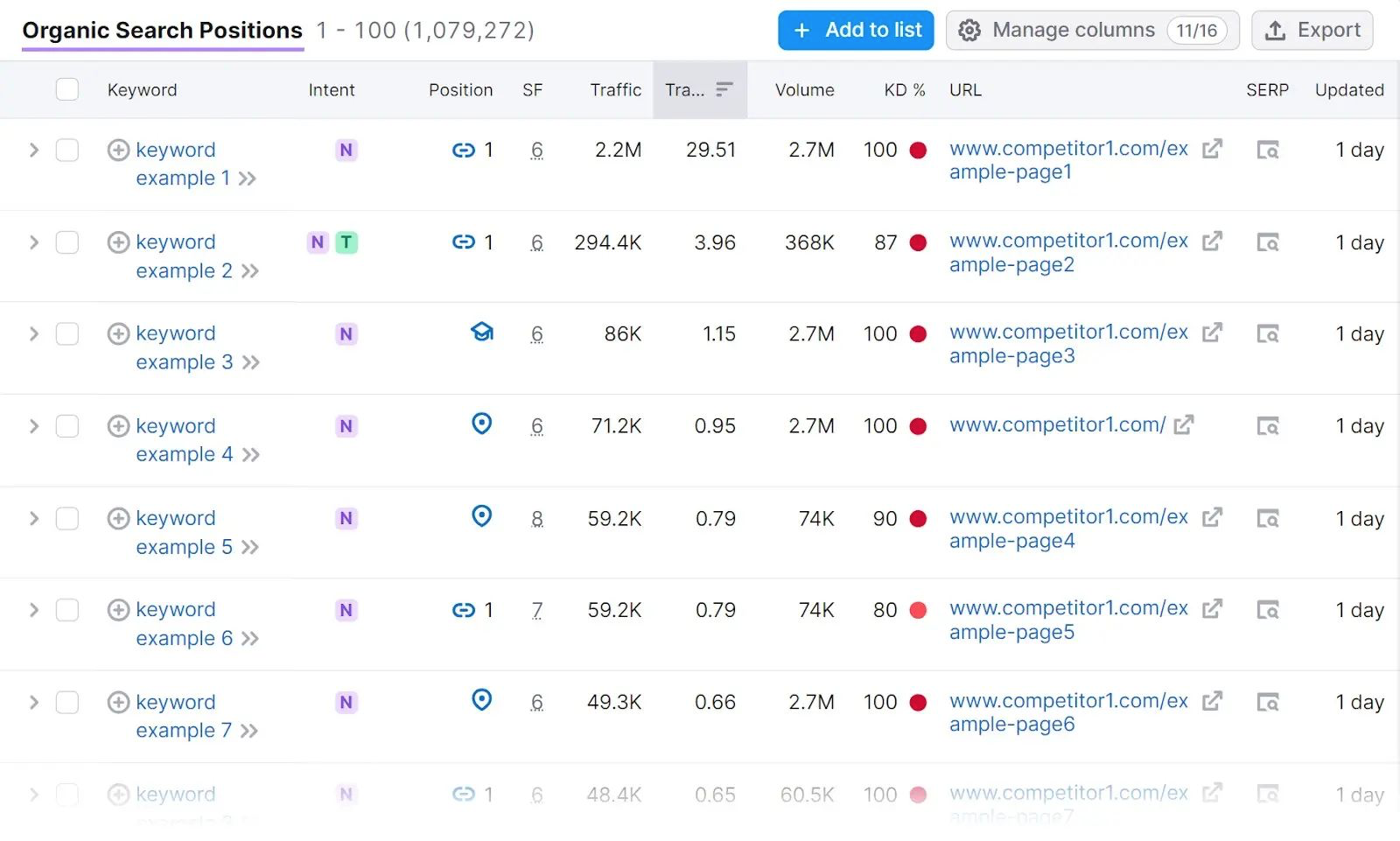

Use the Semrush Organic Research tool to find out which keywords your competitors are ranking for in organic search. And how much traffic they’re getting.

Here’s how to use the Organic Research tool:

On the home screen, enter your domain, select your location from the drop-down, and click on “Search.”

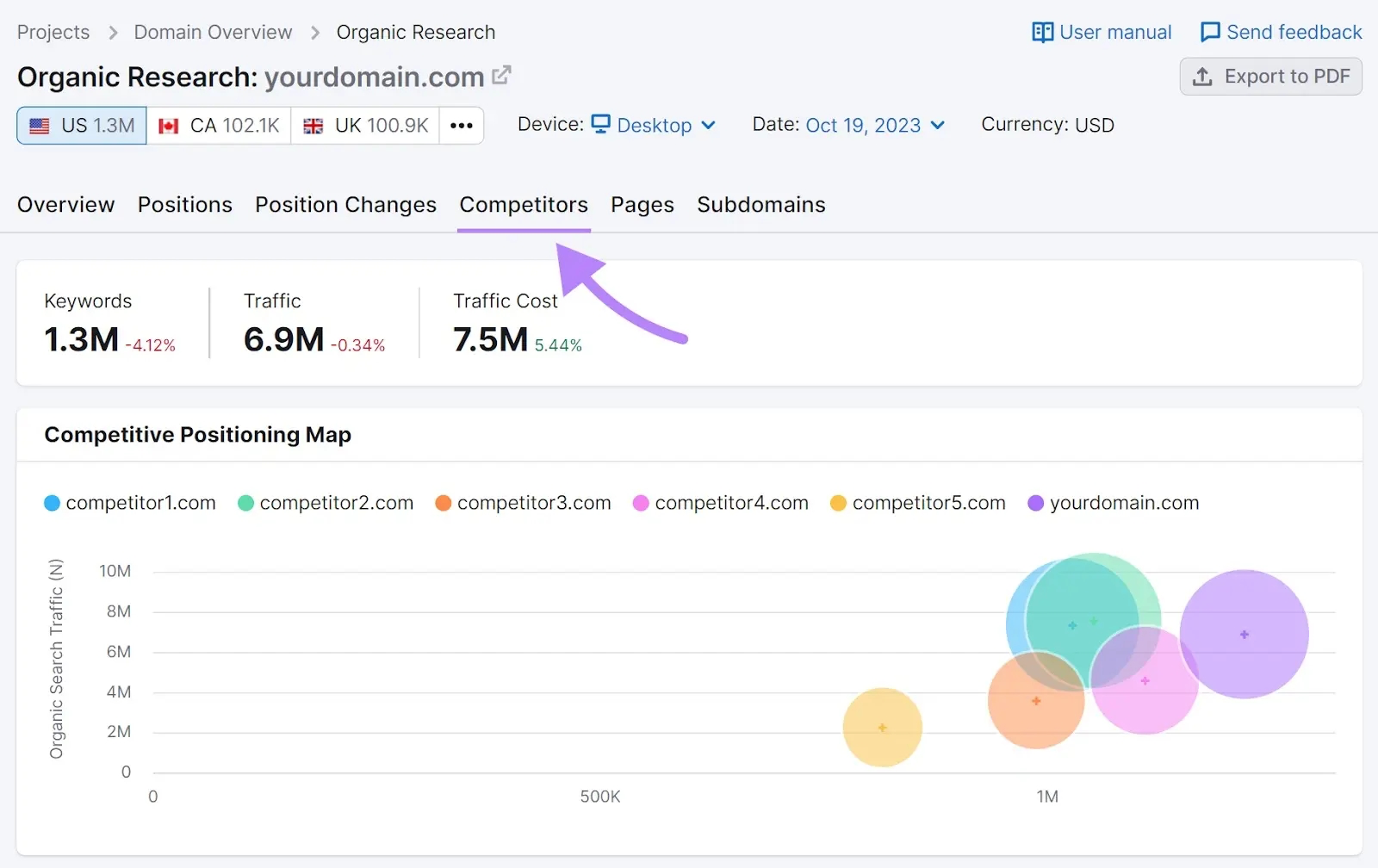

Next, visit the “Competitors” tab.

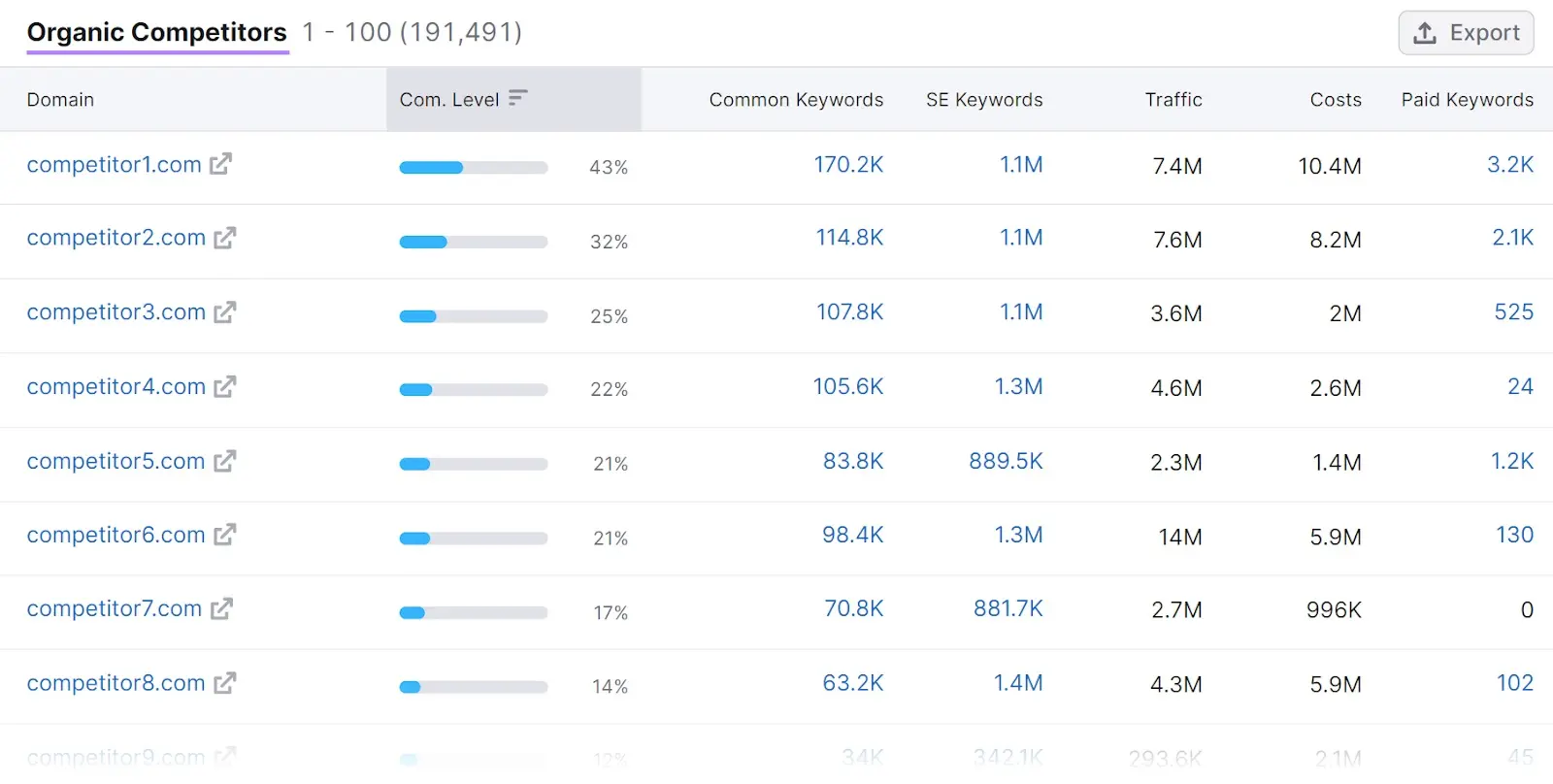

Here, review all the websites you’re competing with in organic search results.

You’ll be able to see how much traffic they’re getting. And how many keywords they rank for.

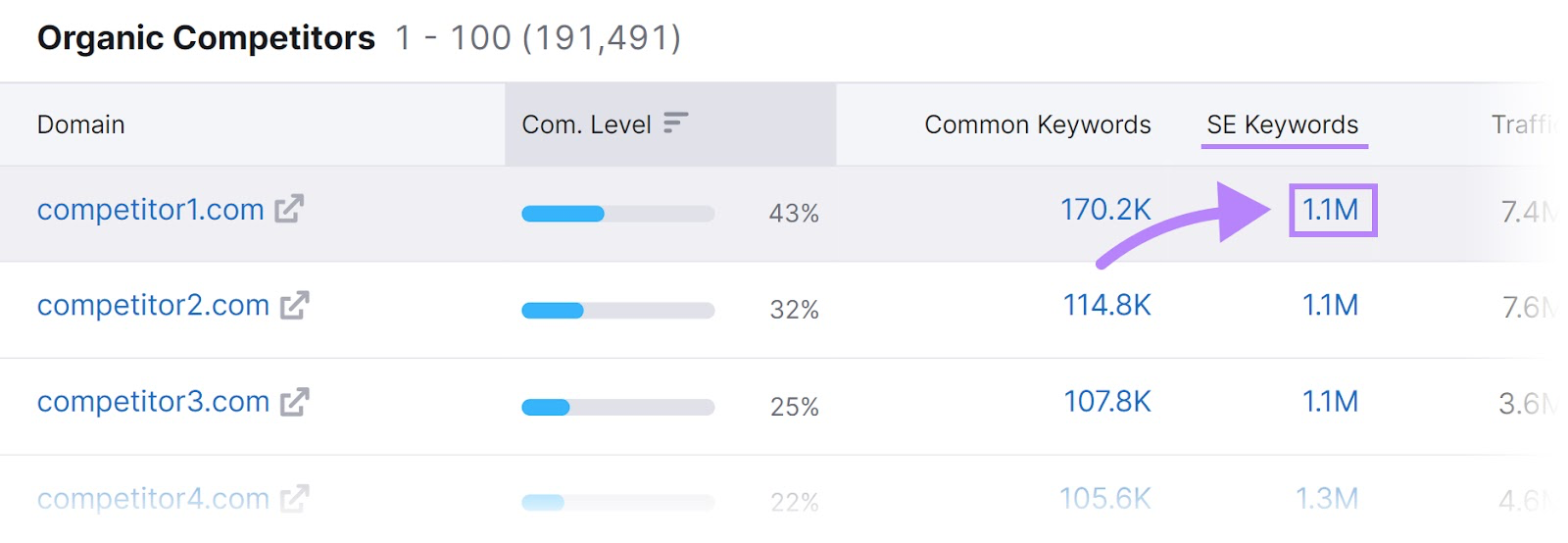

If you’d like to see the exact keywords a competing website ranks for, click on the number in the “SE Keywords” column.

You’ll be presented with a detailed report that looks like this:

Here, review all the keywords a competing website ranks for, along with the search volume and estimated traffic numbers for each keyword.

Advertising Research

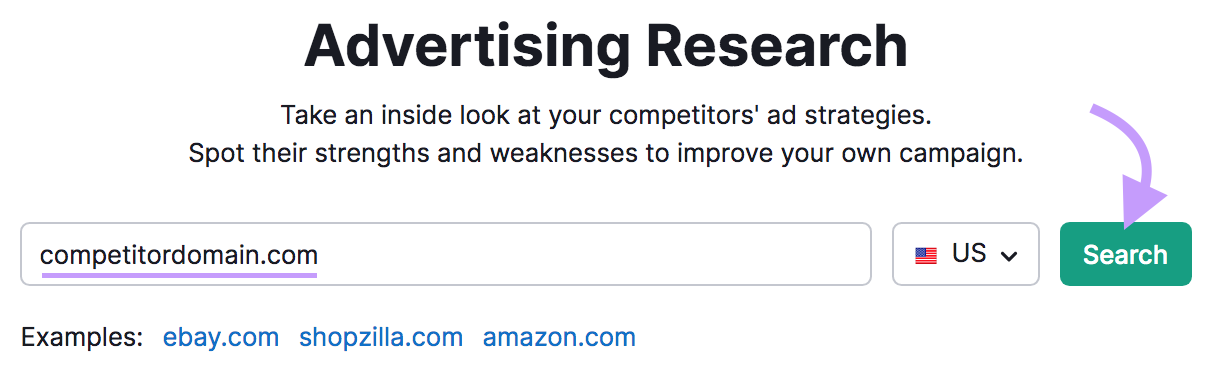

Use Advertising Research to identify websites you’re competing with in Google’s paid search results (known as Google Ads). You’ll also find out how much they’re spending on paid advertising and which keywords they’re bidding on.

It can even show you the exact ads your competitors are using. And their landing pages.

Here’s how to get started:

Enter a competitor’s domain, select a location from the drop-down if you want to, and hit the “Search” button.

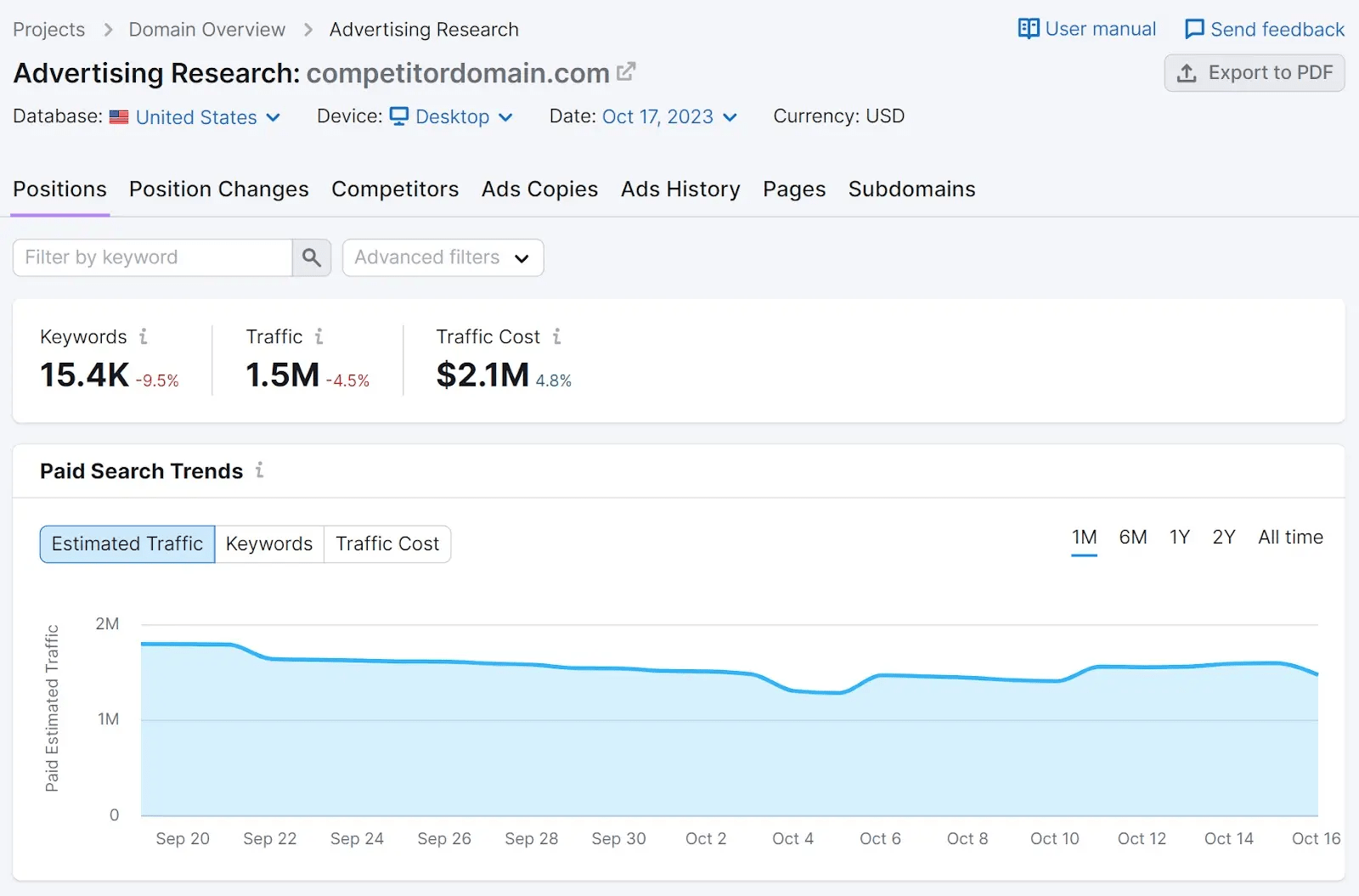

In a few seconds, the tool will generate a detailed report on your competitor’s advertising activity.

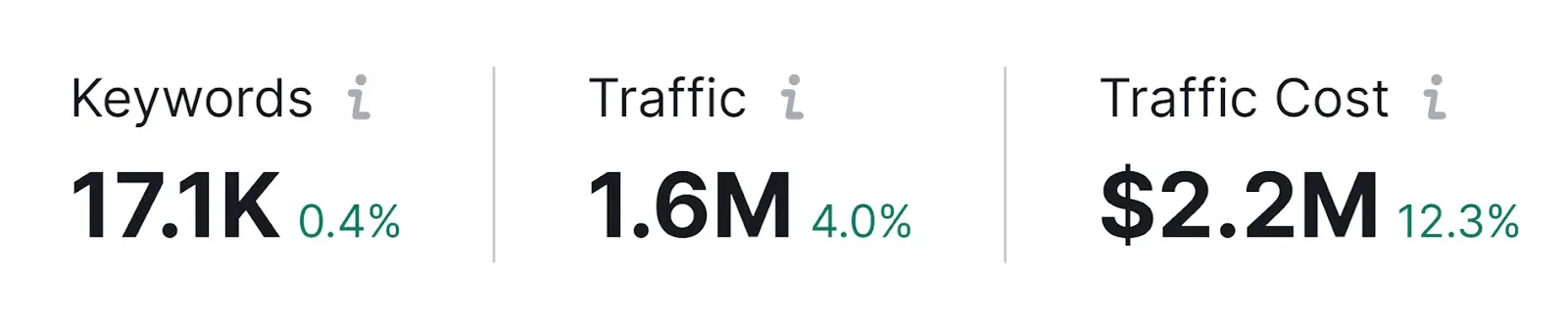

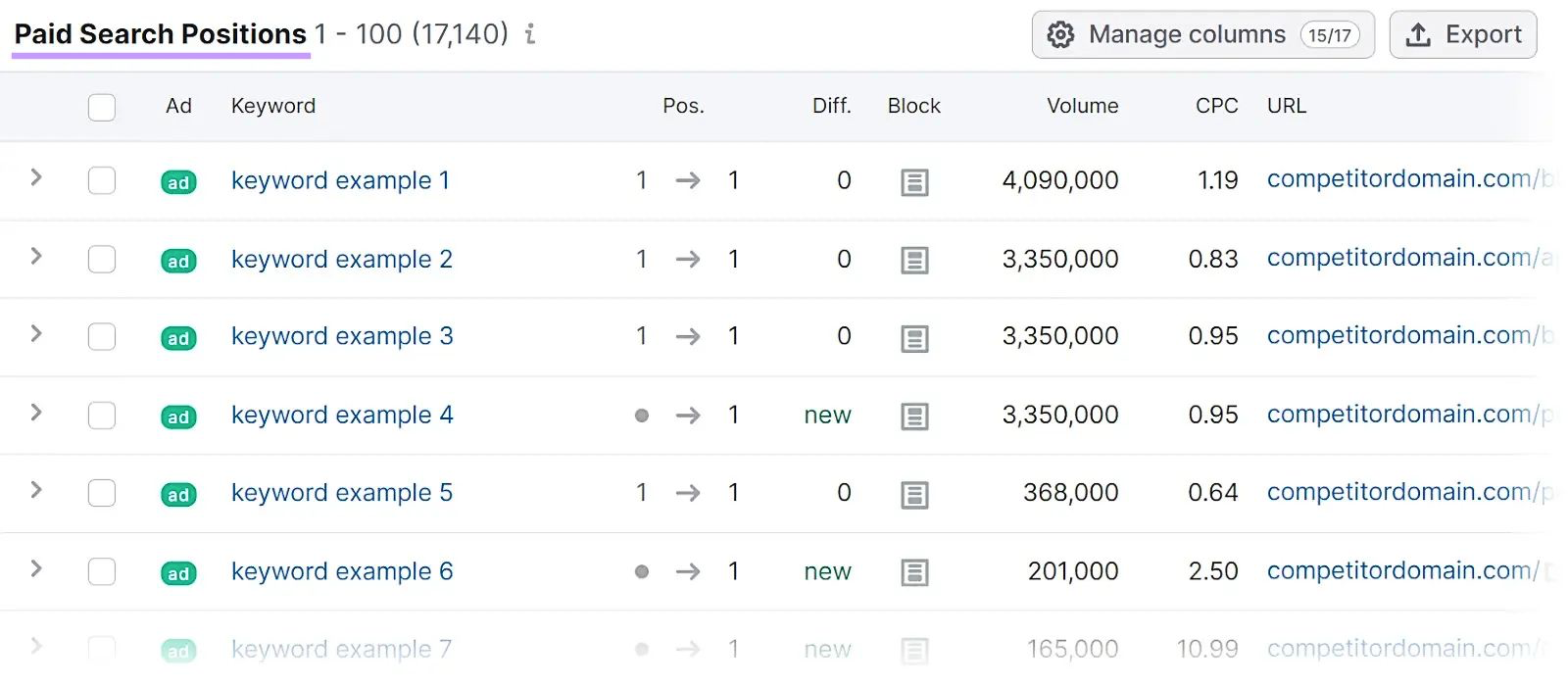

Visit the “Positions” tab to see how many keywords your competitors are targeting through paid search, how much paid traffic the ads are driving to their website, and how much that’s costing them.

Scroll a bit further down, and you’ll see the keywords they’re bidding on.

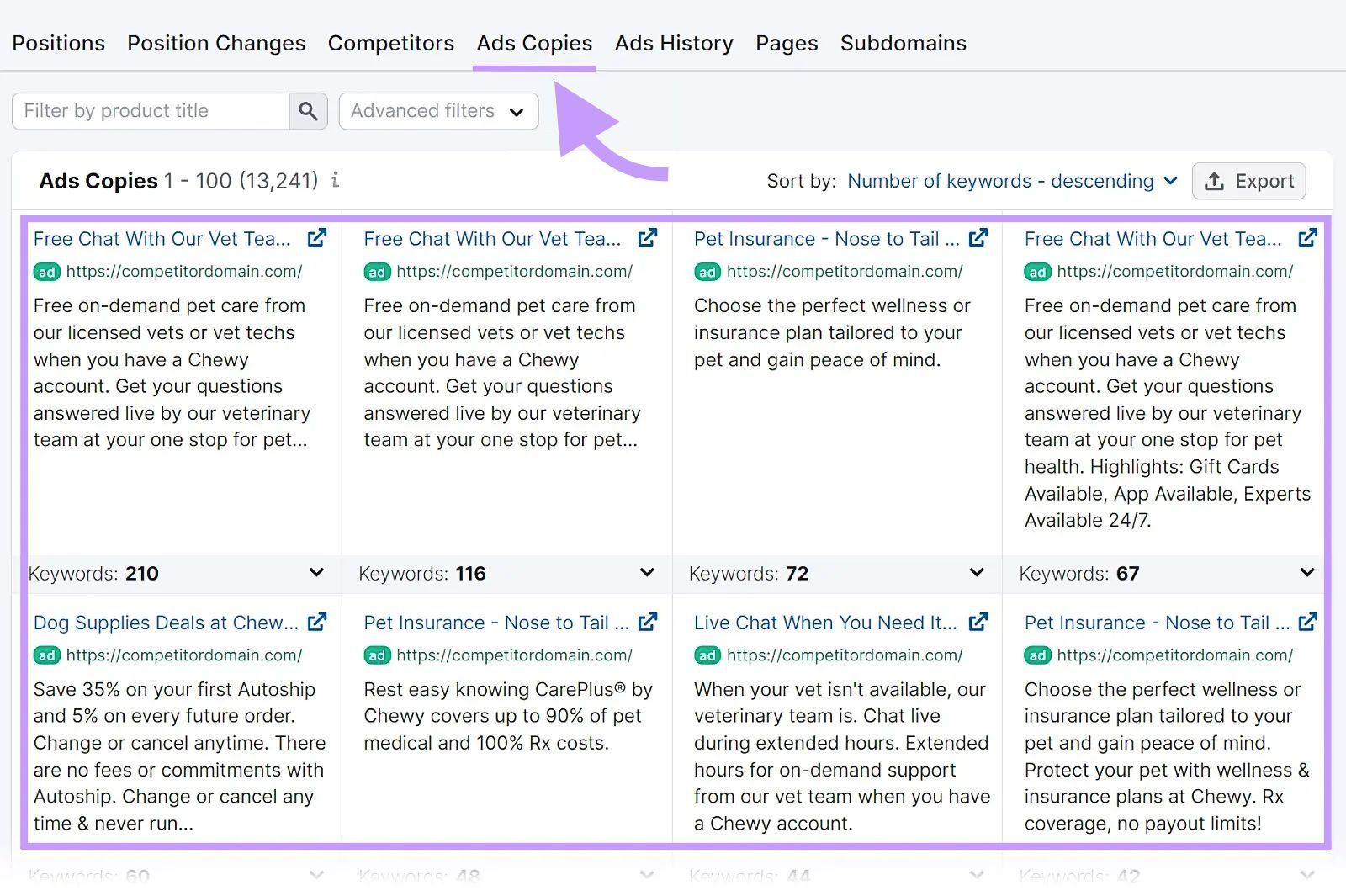

Visit the “Ads Copies” tab to see the actual ad copy they’re using in their search ads.

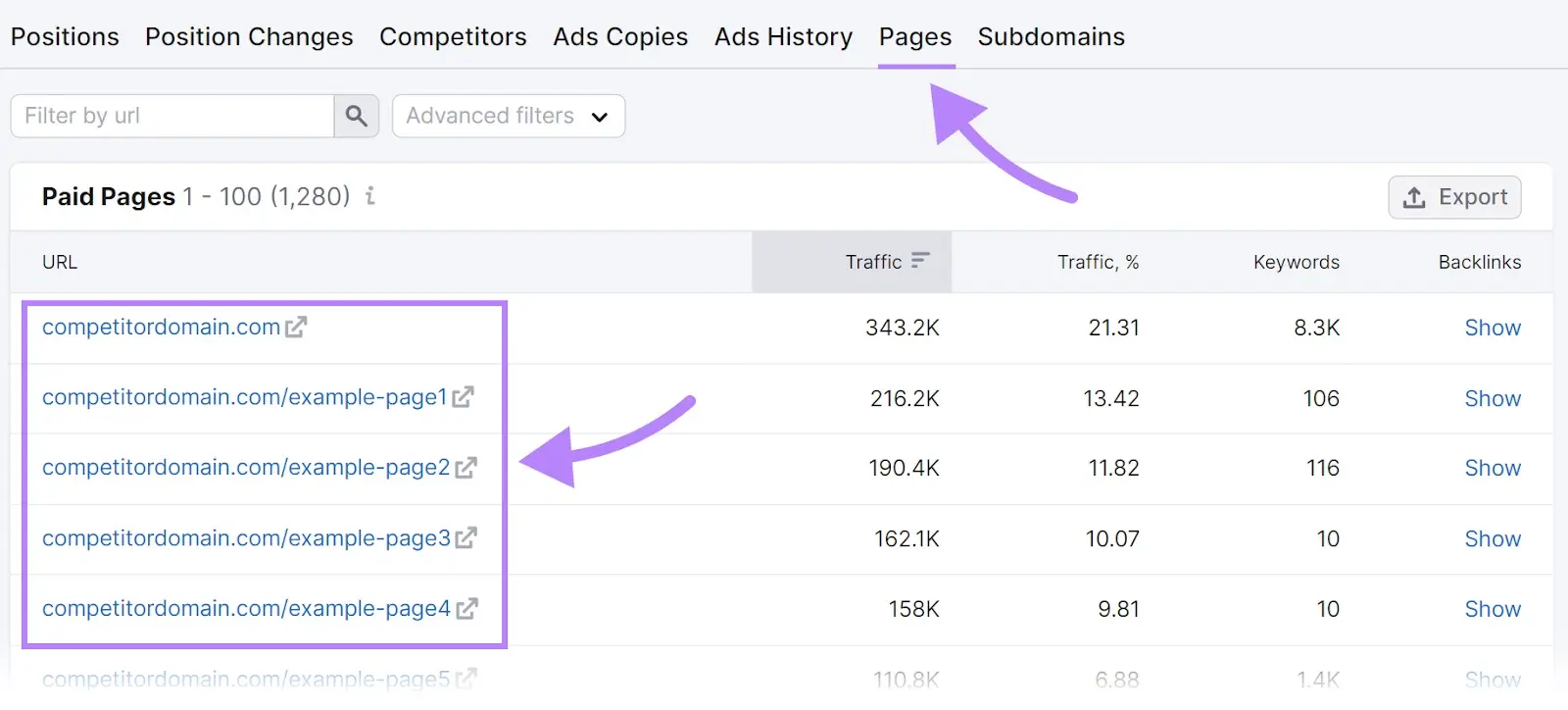

To see the landing pages they’re using, go to the “Pages” tab.

Semrush .Trends

Semrush .Trends allows you to gather market insights and dive deep into specific competitors.

Let’s explore the four tools it includes:

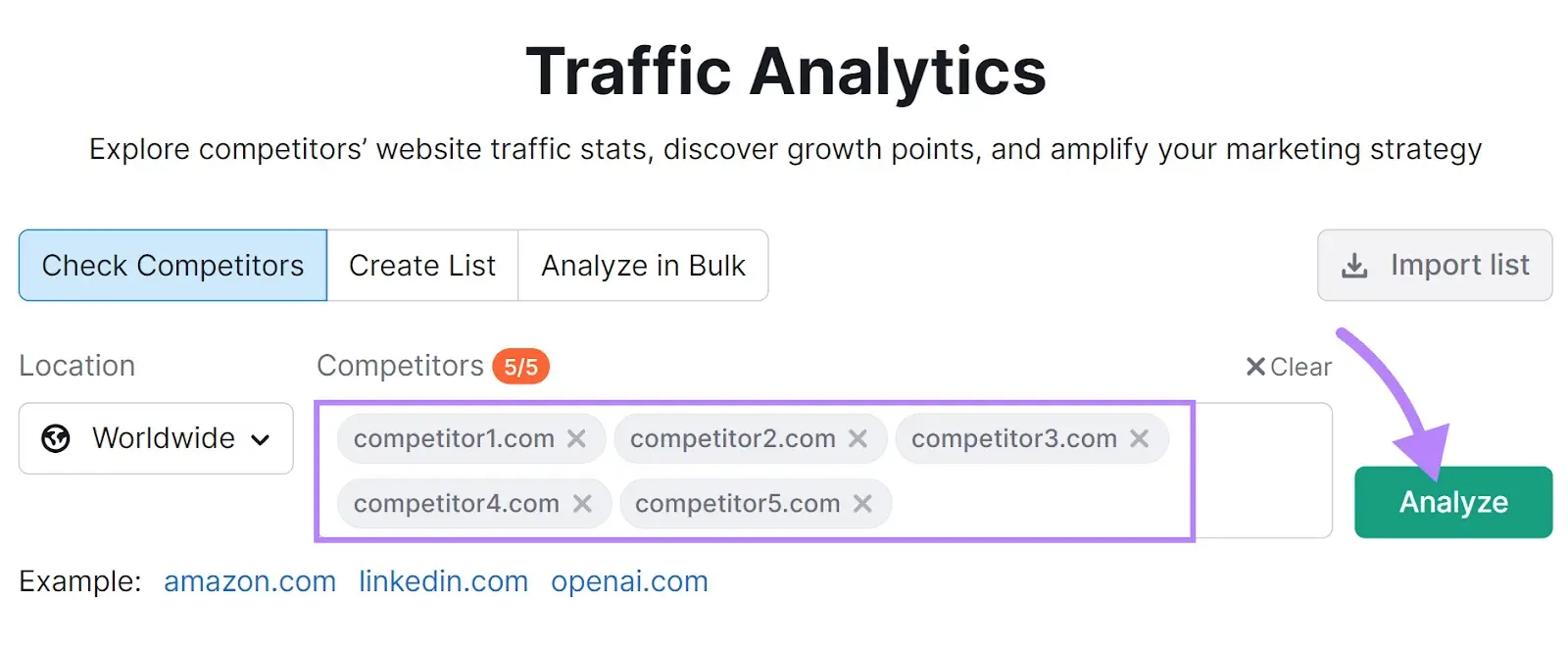

Traffic Analytics

Traffic Analytics can give you in-depth insight into your competition’s website traffic, their most popular traffic sources, the geographical breakdown of their visitors, and more.

Here’s how to get started:

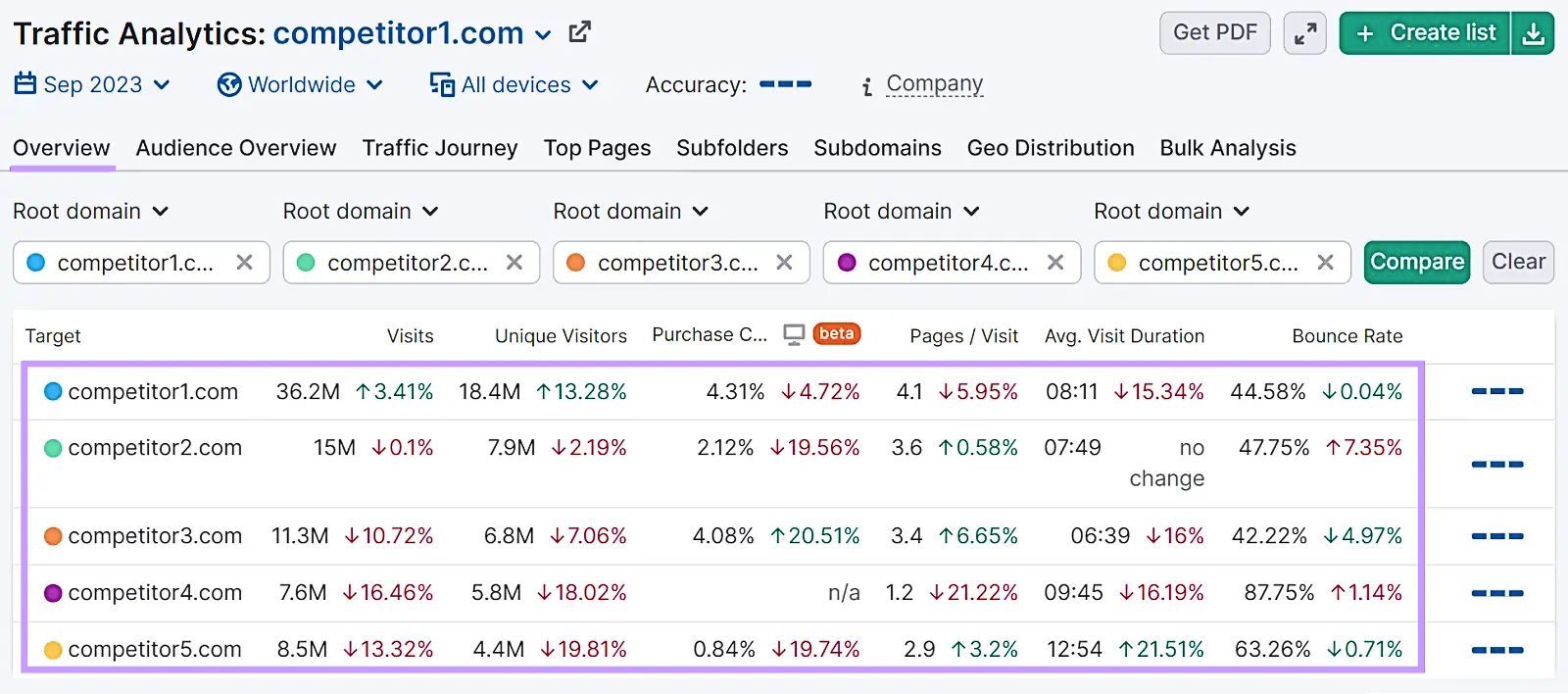

On the Traffic Analytics page, enter the domains of up to five competitors. Adjust the location using the drop-down if you want to. Then click on “Analyze.”

After a few seconds, the tool will generate a report on your competitors.

Use the “Overview” tab to see your competitors’ traffic numbers and related metrics at a glance.

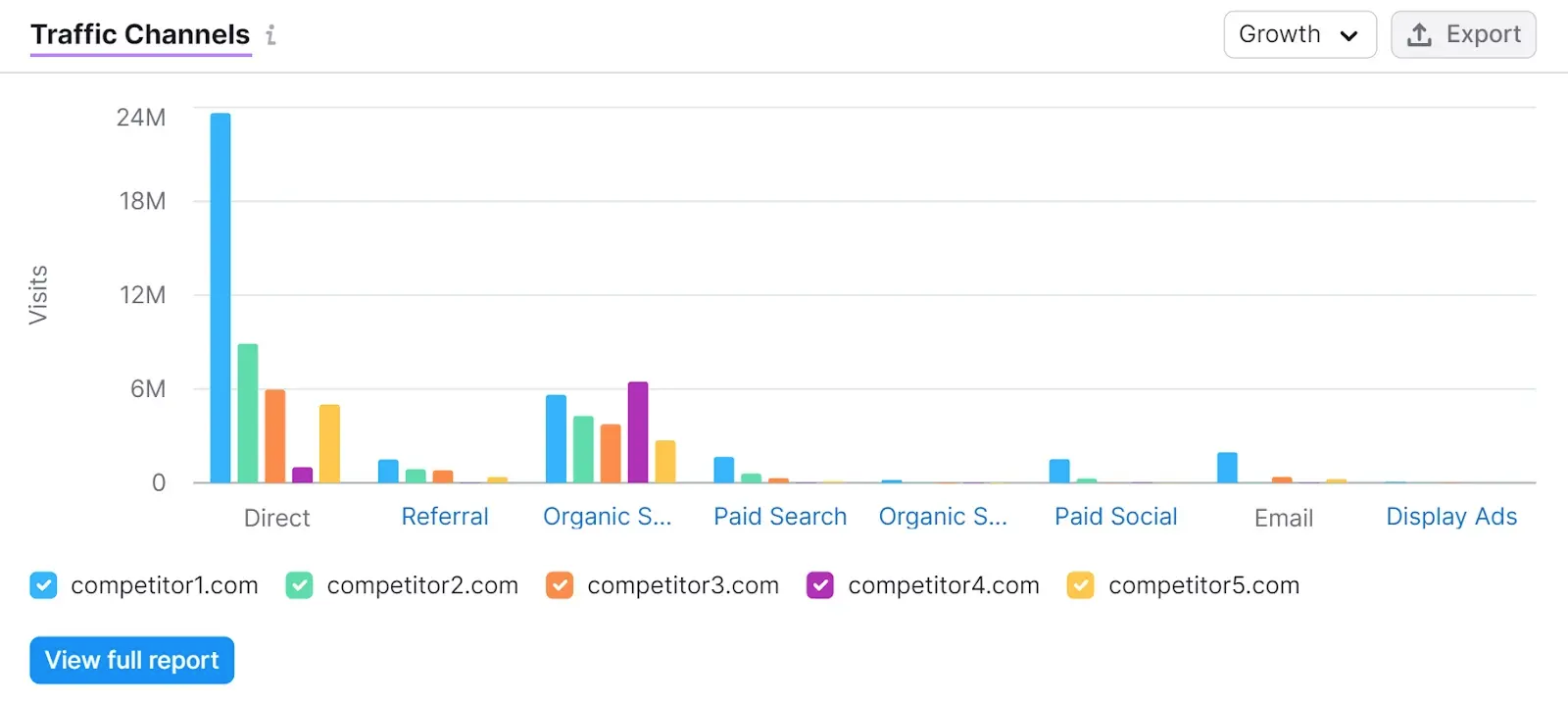

To see their most popular traffic channels, scroll down to the “Traffic Channels” section.

This particular report can help you understand the popularity and effectiveness of different channels for your target market.

Market Explorer

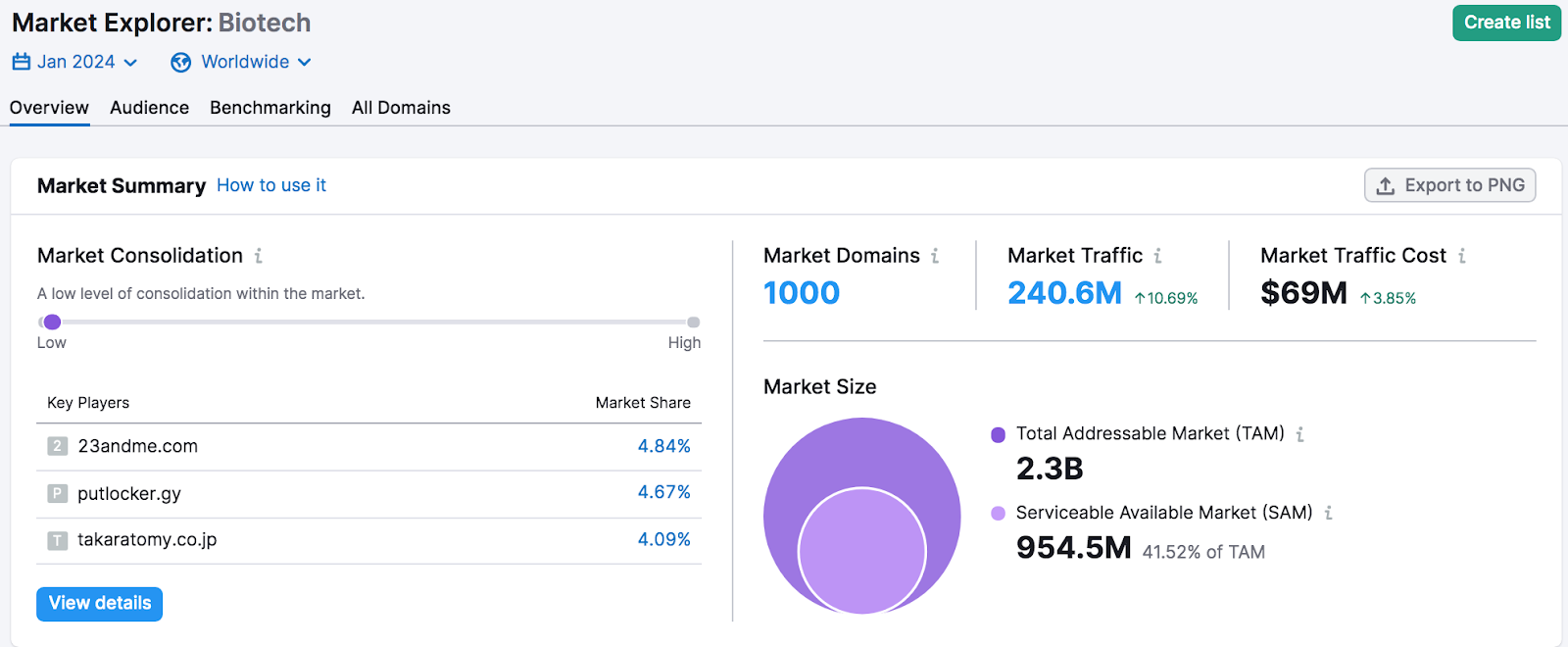

Market Explorer allows you to get a better understanding of your industry and benchmark your performance against competitors.

It can show you the total size of your market, your business’ market share, and more.

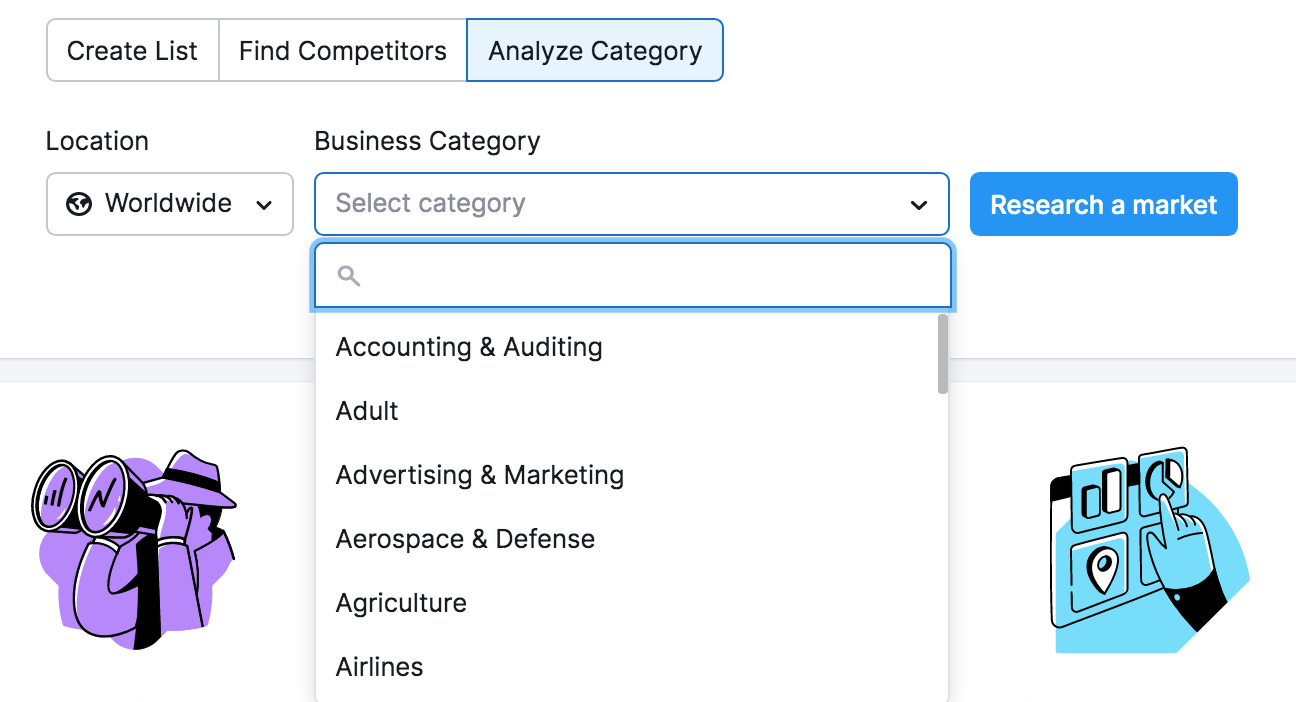

To get started, click on the “Analyze Category” tab. Choose your business category from the available options in the drop-down menu, then click the “Research a market” button.

The tool will generate a report on your market. You’ll be able to see key players, their market share, the total market size, and more.

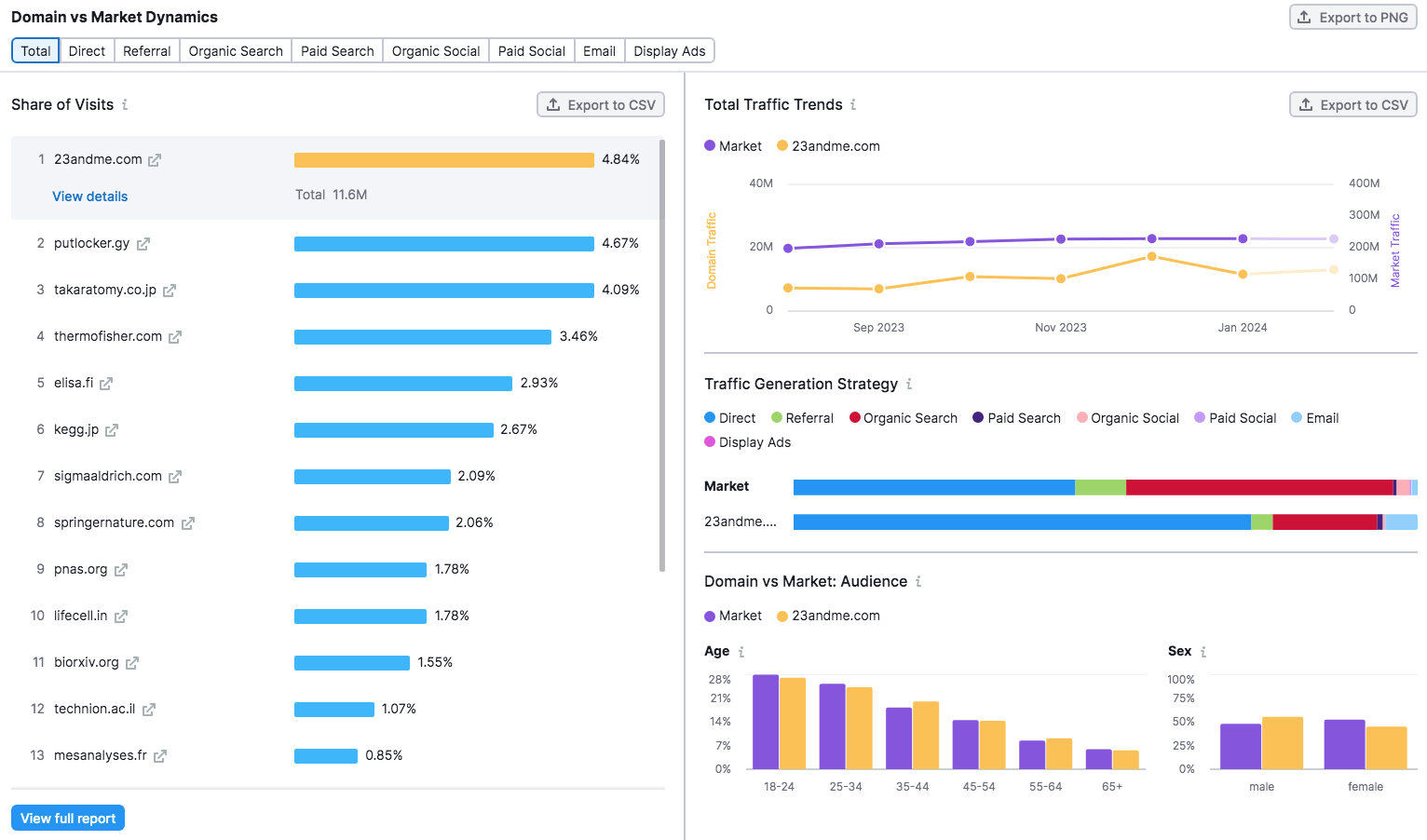

To see how your website compares to your competition, scroll down to the “Domain vs Market Dynamics” section.

Here, you’ll be able to see the percentage of total traffic taken up by different competitors, their most popular traffic channels, and more.

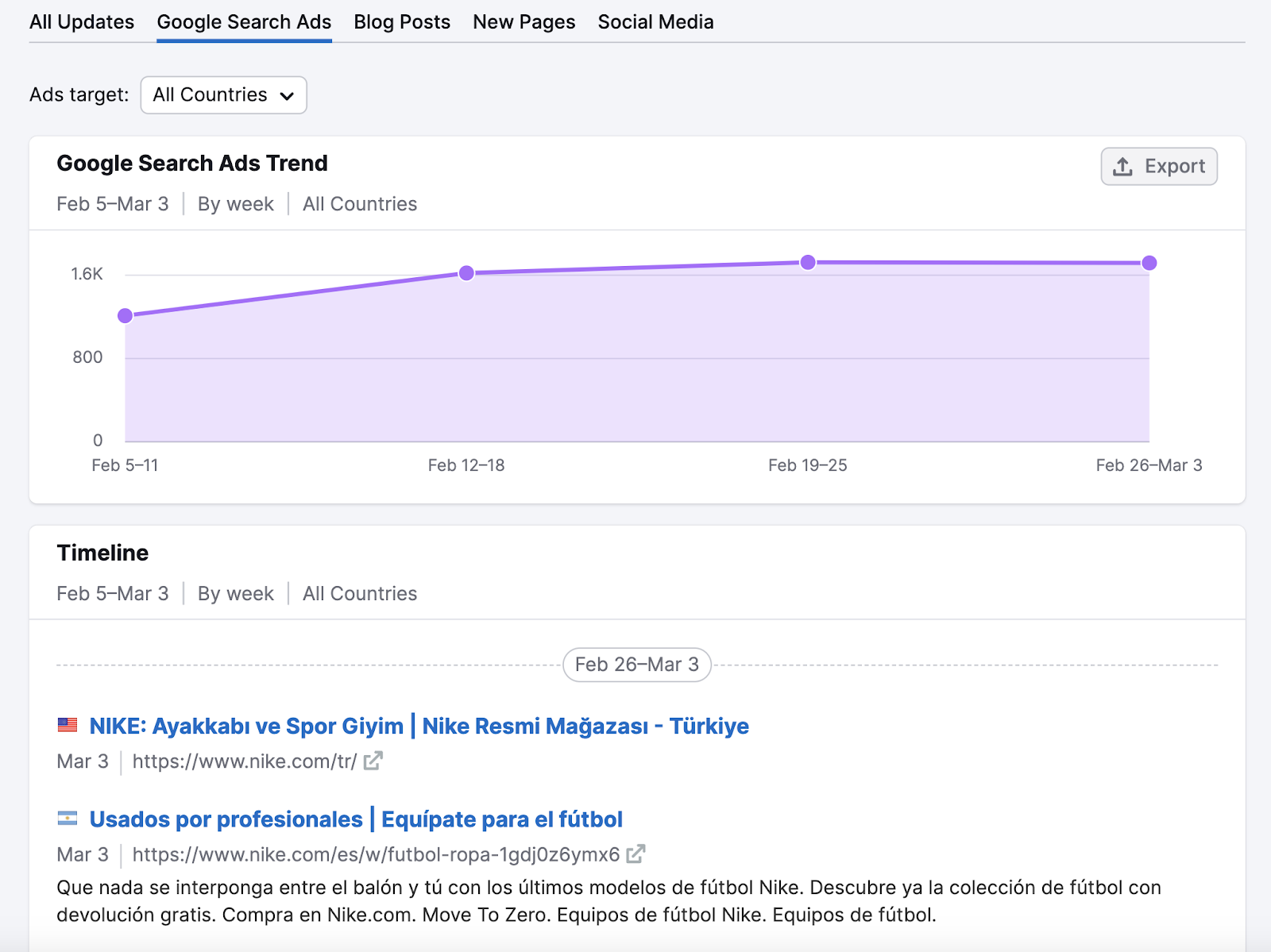

EyeOn

The EyeOn tool allows you to monitor your competitors’ publishing activities.

This includes:

- Google Search ads

- Blog posts

- Webpages

- Social posts on Facebook, Instagram, and X (formerly Twitter)

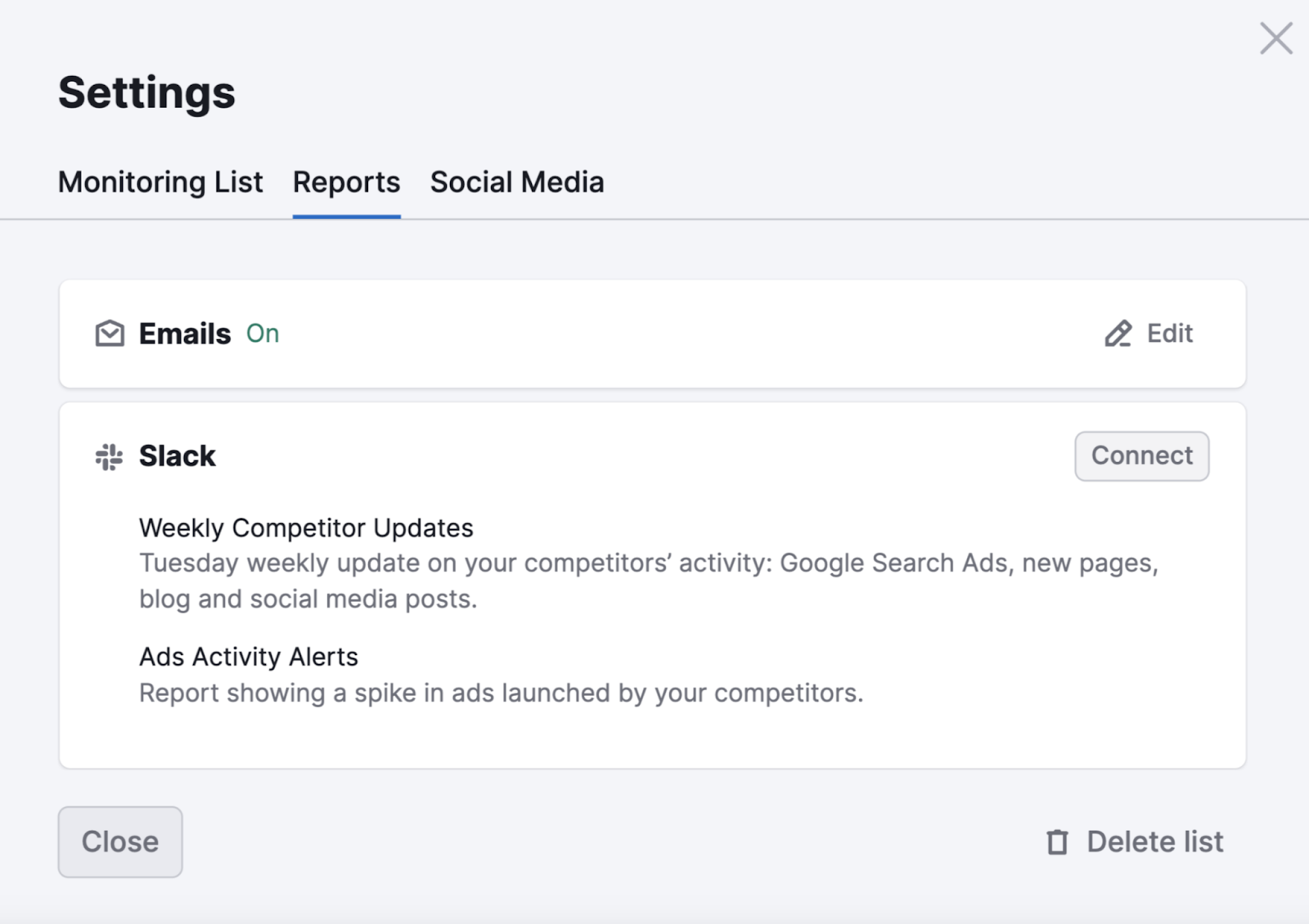

You can log in anytime to view the latest updates.

But we also recommend that you sign up for weekly Slack or email reports. And enable ads activity alerts.

That way, you can quickly identify changes in your rivals’ marketing strategies. And ensure your business keeps pace.

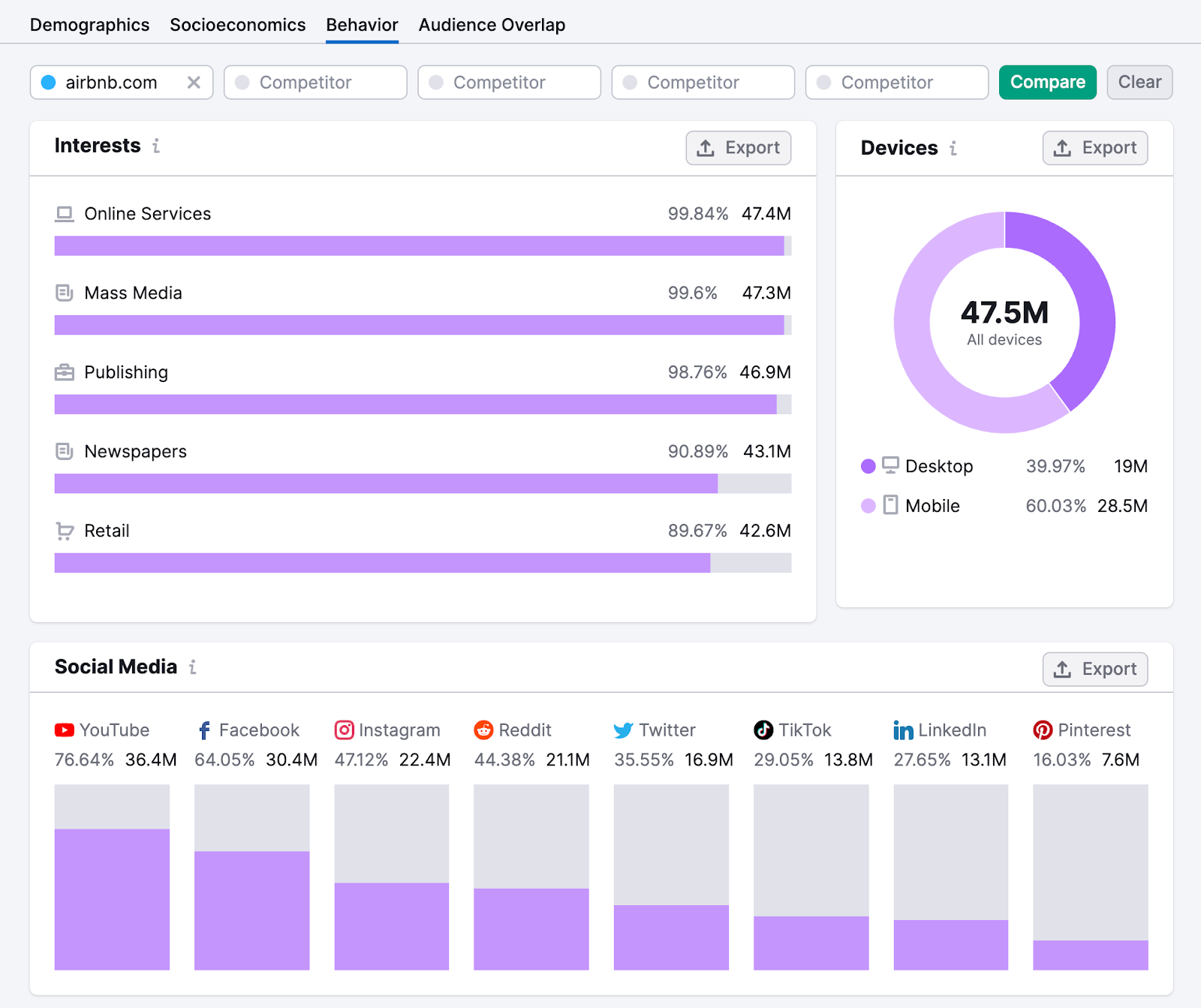

One2Target

One2Target is an audience research tool.

Select the “Create list” tab, enter the domains of up to 100 competitors, choose your target location, and click “Analyze.” And the tool will gather insights about your market’s audience.

You’ll get the following reports:

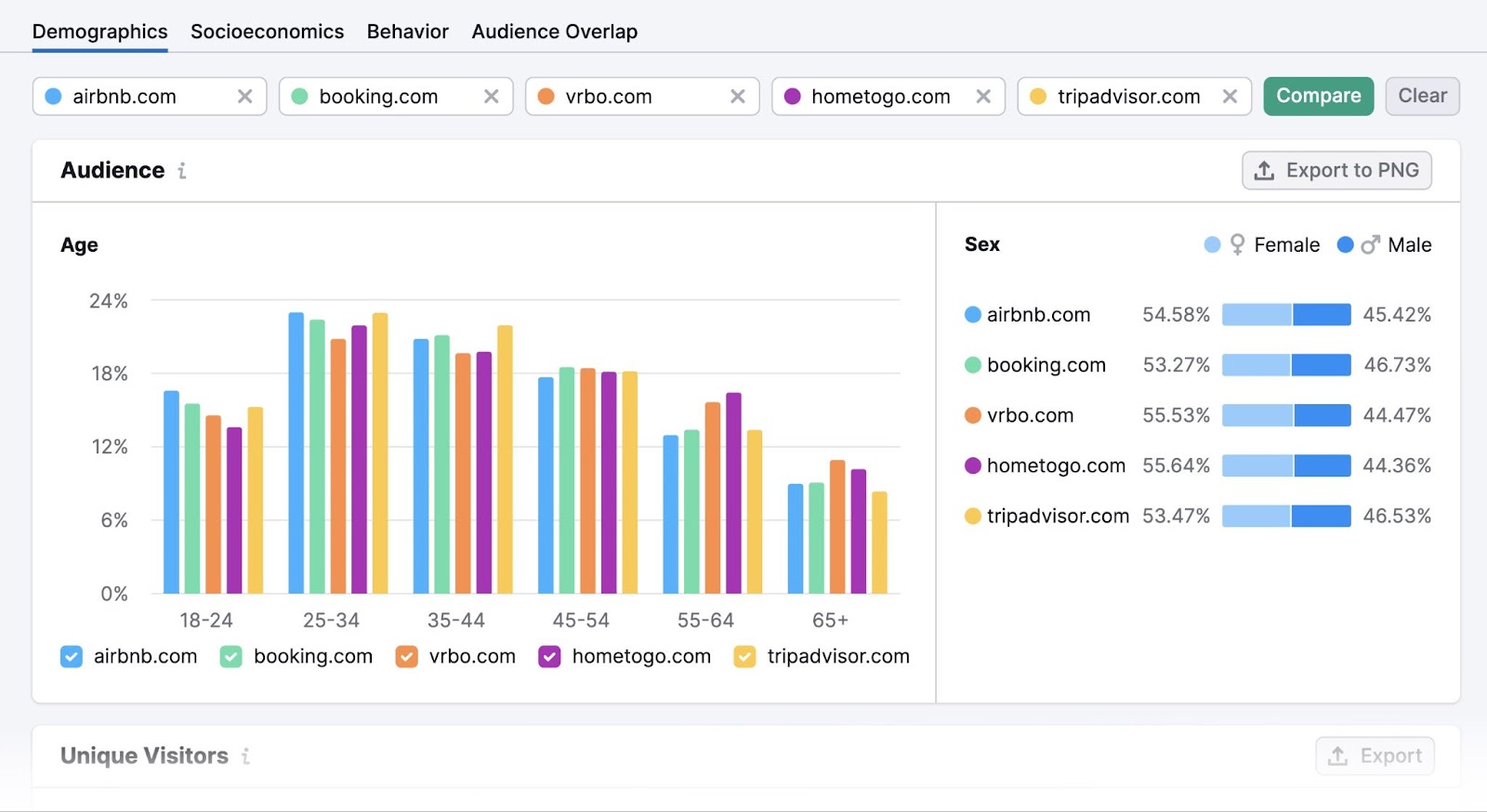

- Demographics: See how many unique visitors your competitors have attracted over time. And look at age, gender, and country breakdowns.

- Socioeconomics: Get details on your market audience’s household size, income level, employment status, and education level

- Behavior: Discover your market audience’s top interests and most-visited social media platforms. You can also see whether they lean more toward desktop or mobile.

- Audience Overlap: Find out which other domains your audience visits most. And the categories those sites fall under.

Plus, you can easily view comparisons for up to five competitors.

Audience Intelligence

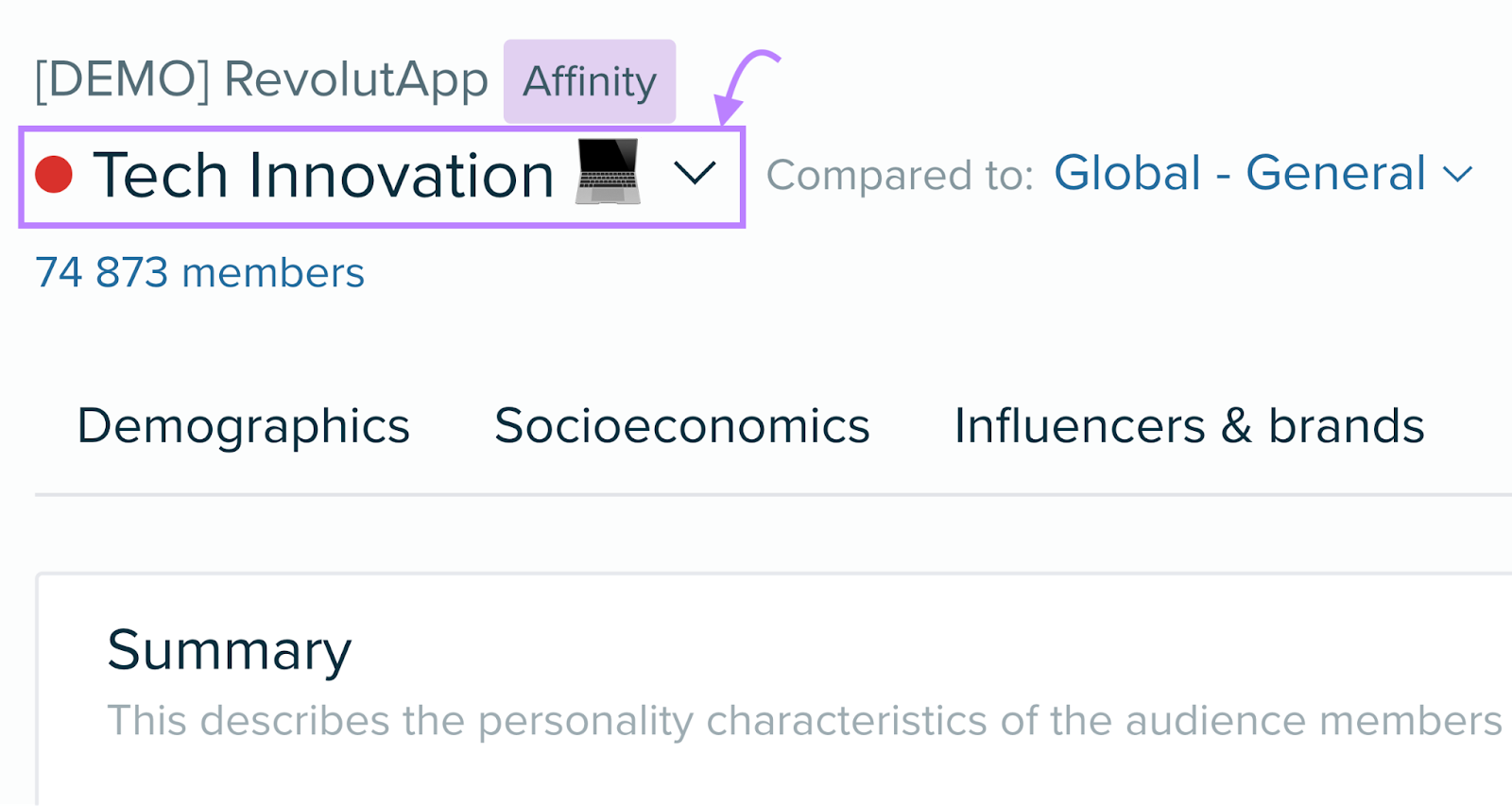

The Audience Intelligence app provides detailed insights into audiences on X (formerly Twitter).

Simply enter the handle of an account with a relevant follower base (e.g., your own or one that belongs to a popular influencer in your niche).

Then, the app will analyze the account’s followers. And separate them into segments.

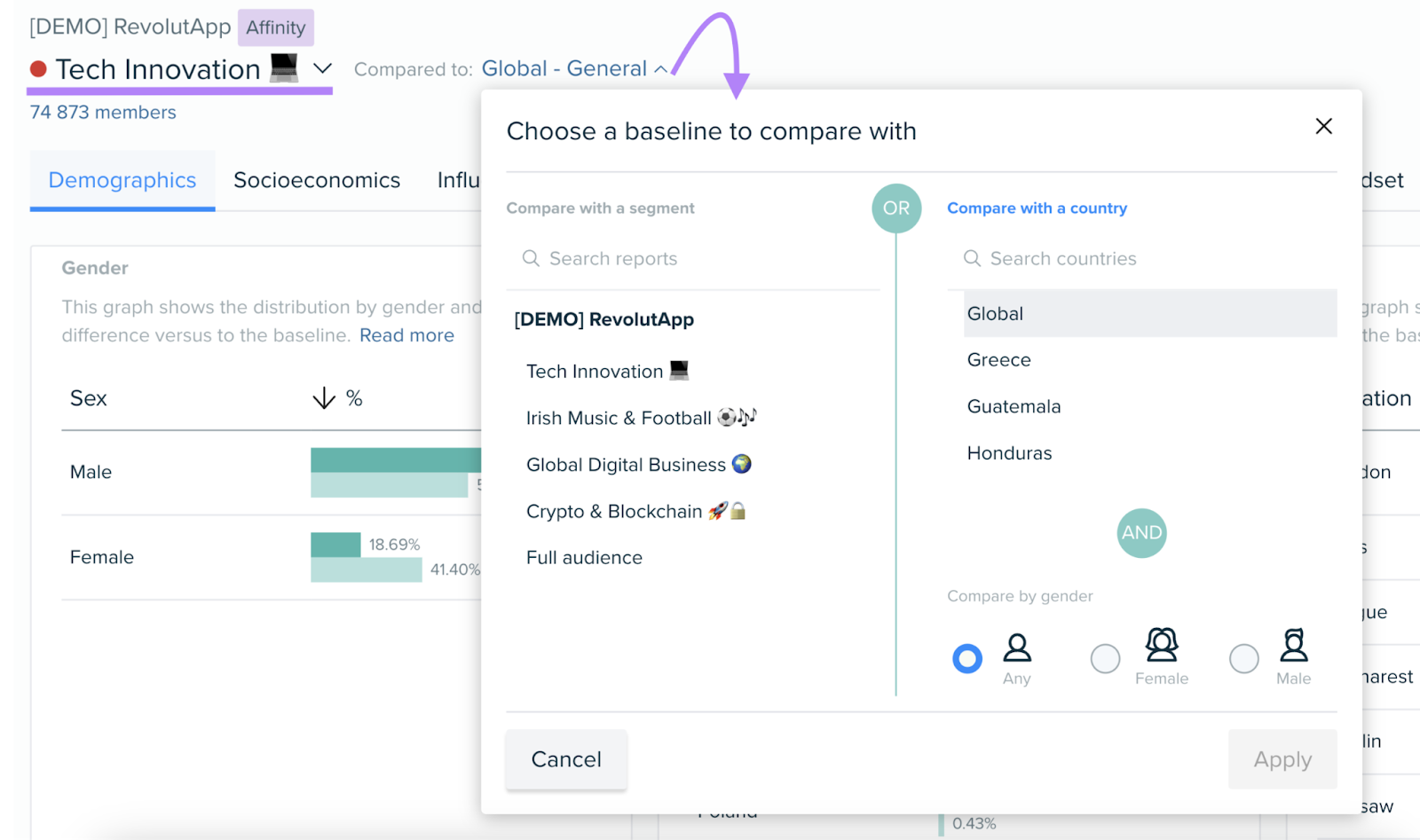

Click any segment to view detailed reports on its demographics, socioeconomics, and much more.

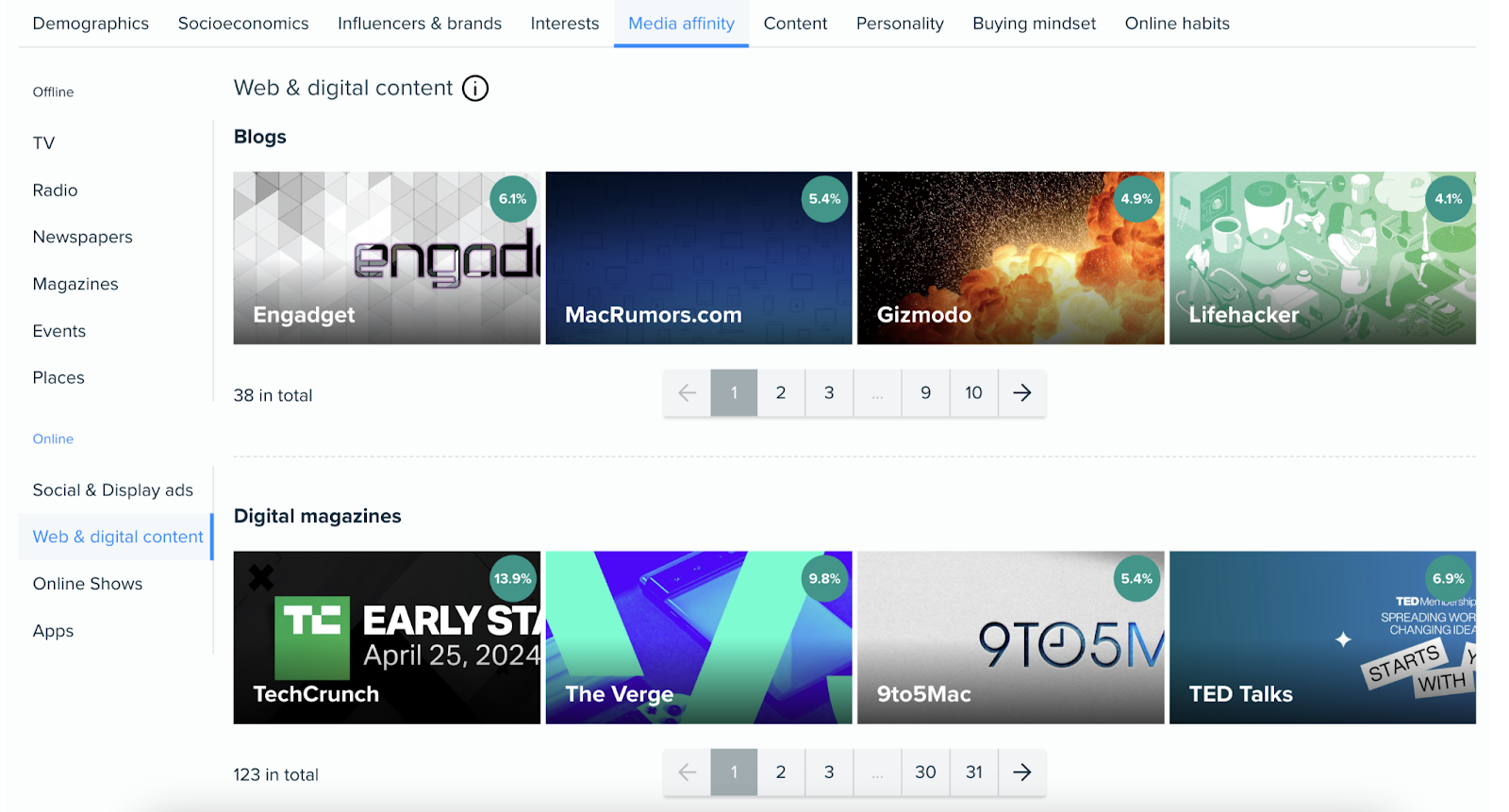

For example, the “Media affinity” report lets you see which blogs and apps the audience segment is most interested in.

You can easily compare it against other segments. Or a baseline for a particular country and gender.

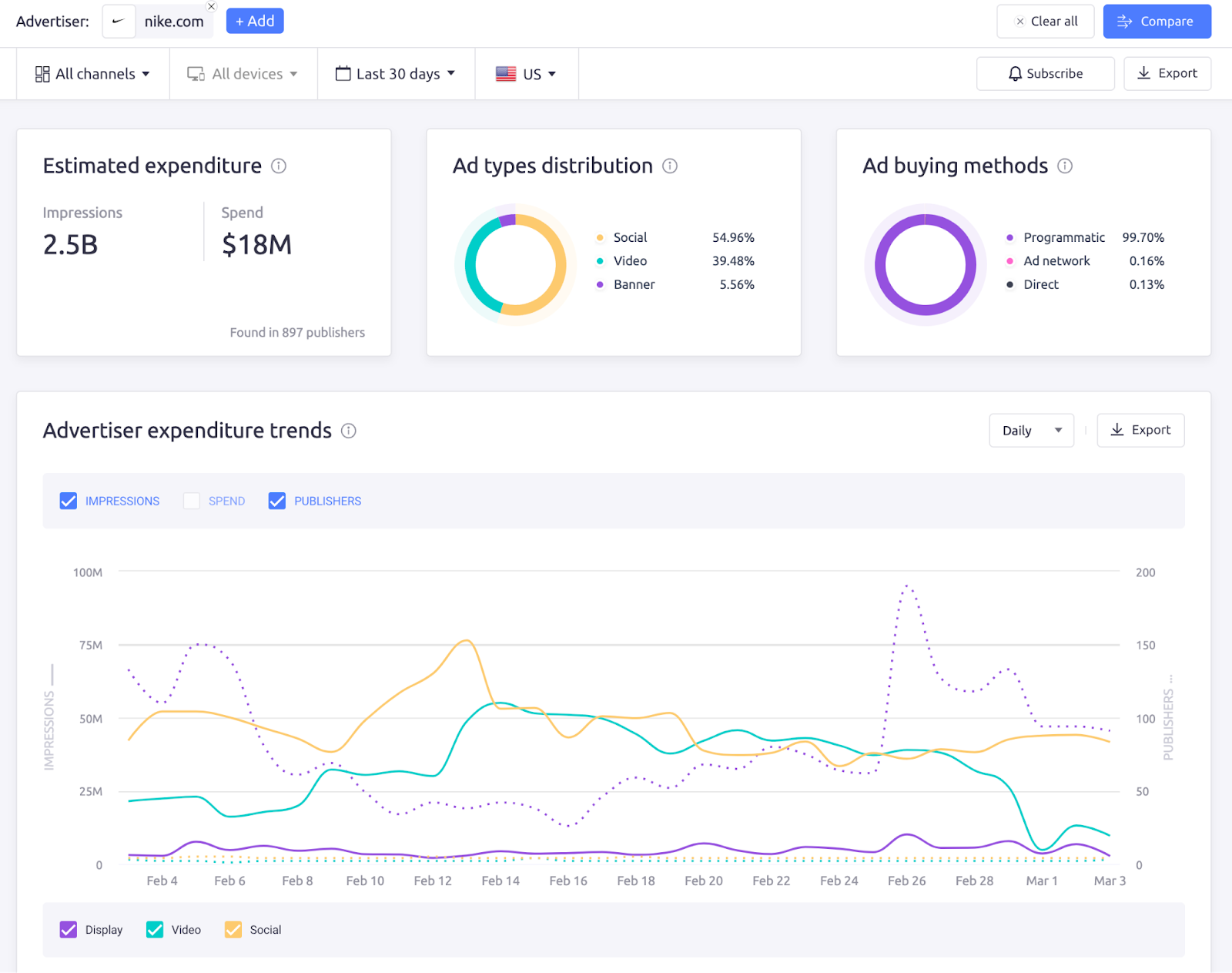

AdClarity

The AdClarity app lets you take a deep dive into competitors’ social, video, and display advertising campaigns. So you can gather insights for your own digital advertising strategy.

Enter the name of an advertiser to see details about:

- Estimated expenditure

- Ad types distribution

- Ad buying methods

- Top campaigns

- Top publishers

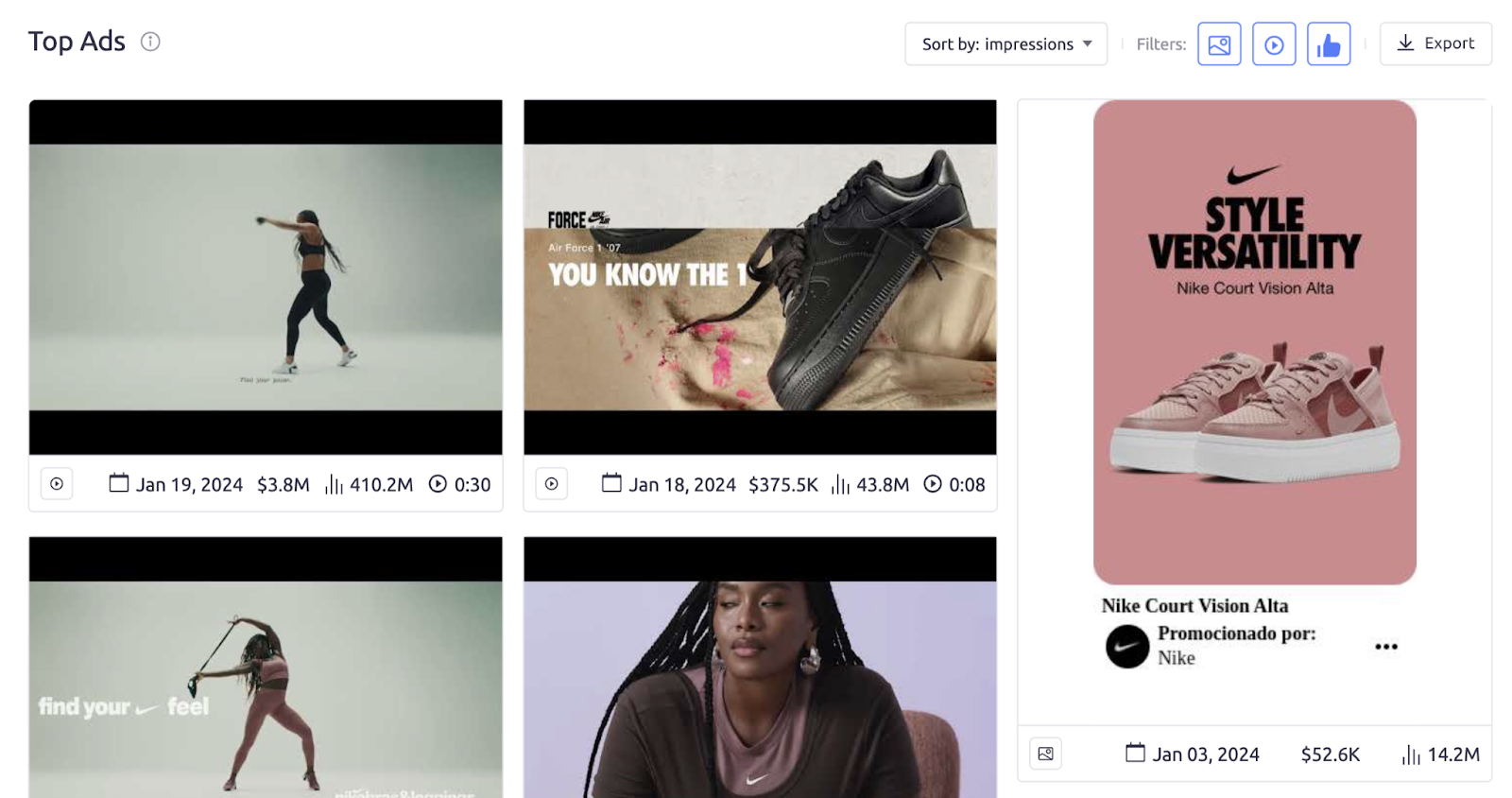

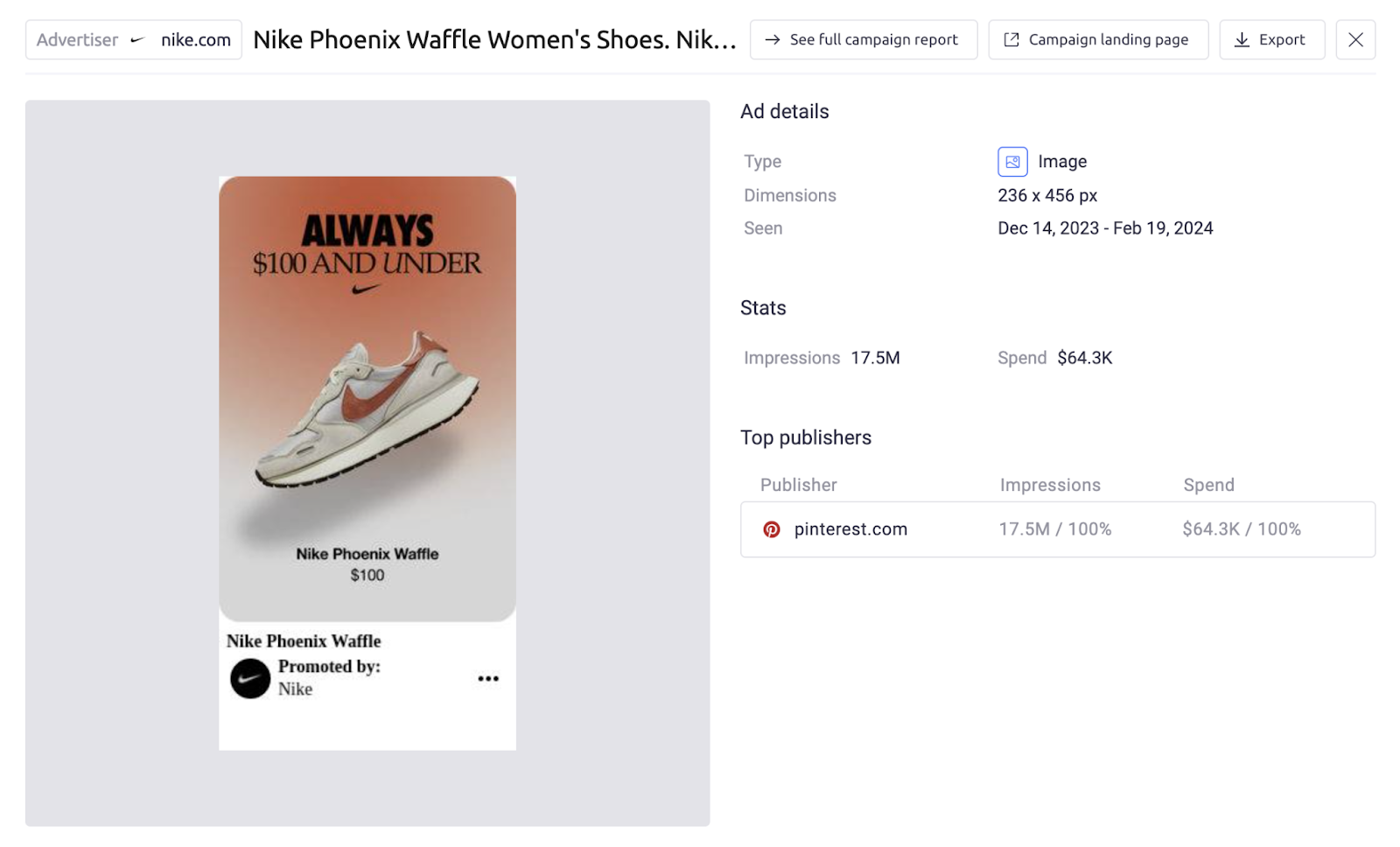

Then, scroll down to the “Top ads” section to explore ads with the most impressions.

You can click any ad to get additional information. Including a link to the campaign landing page.

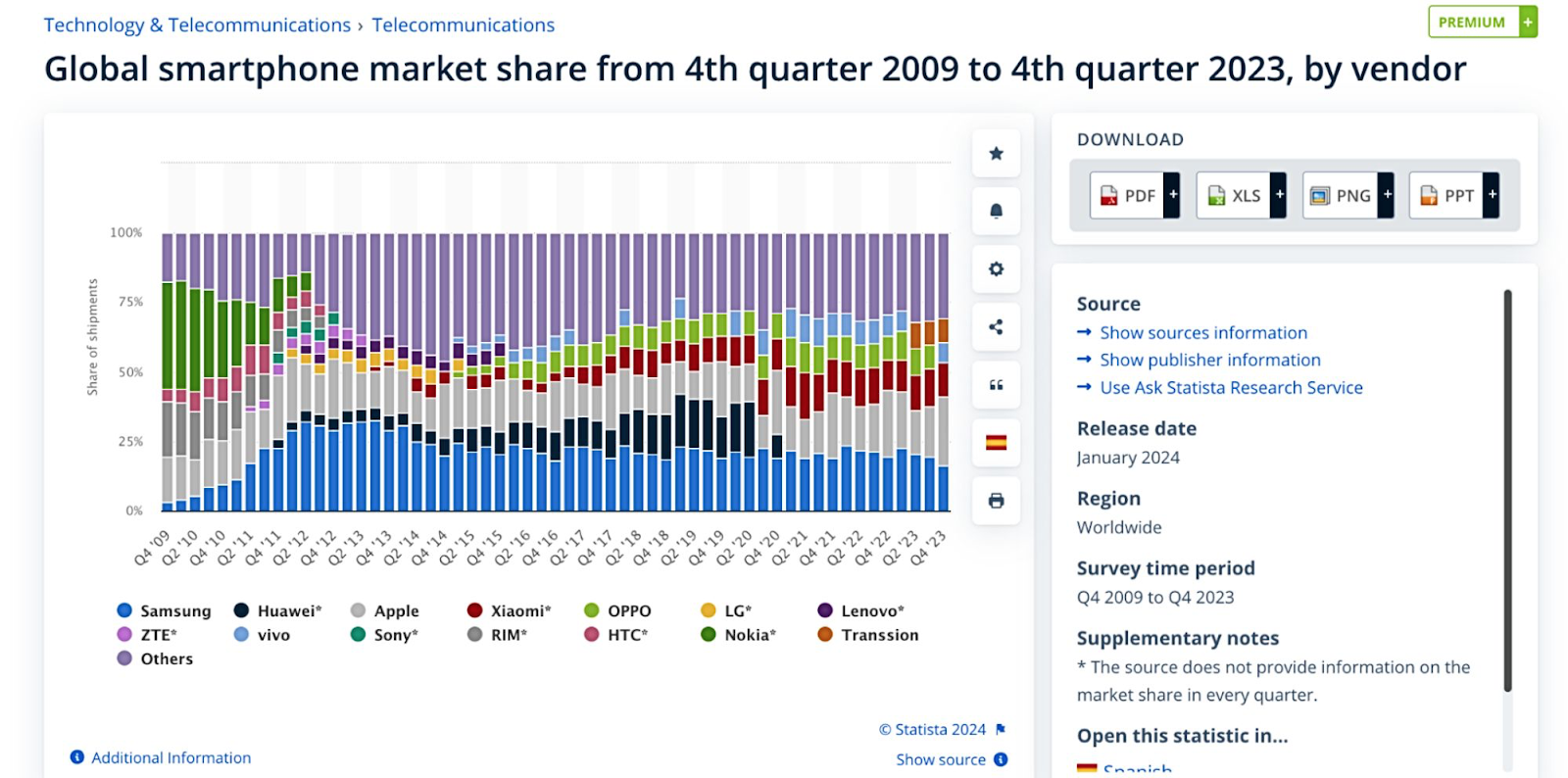

Statista

Statista is a platform that hosts insights, data, and reports on 170 industries and hundreds of topics.

Use it to get market data for more than 190 countries, as well as reports on:

- Trending topics

- Industries and markets

- Consumers and brands

- Politics and society

- Companies and products

- Countries and regions

Statista’s reports can help you understand the dynamics of a particular industry, analyze consumer behavior in specific markets, and more.

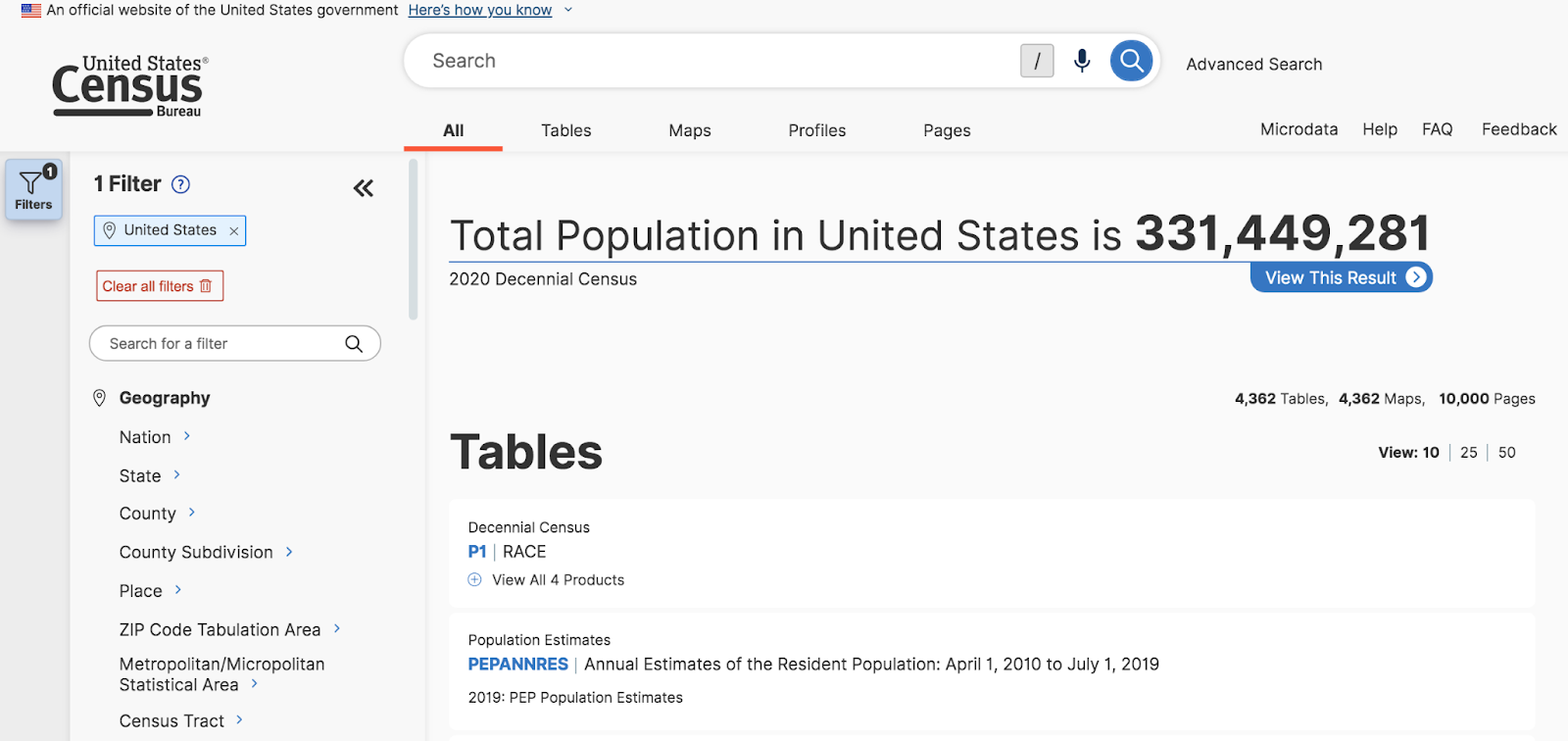

U.S. Census Bureau Website

The official website of the U.S. Census Bureau is another great resource for your market research. Use it to find US census data, including population numbers, demographics data, industry data, and more.

For example, it can be helpful for understanding your target market’s income levels, spending habits, and family structure.

The website offers an extensive filtering system that allows you to find the data you need quickly.

It also offers visualizations for most of the data, which helps make the data easier to understand.

Perform Online Market Research with Semrush

Performing online market research is a crucial part of making data-driven decisions that will help your business succeed in the market.

Take advantage of Semrush tools like Organic Research, Market Explorer, and Advertising Research, to streamline your market research efforts and get valuable data in minutes.